Revenues of Euro 380.5 million (+18.6%) and adjusted net profit

of Euro 16.3 million (+21.6%)

Focus on energy transition and “clean energy economy”

In 2021, SIT returned:

- Consolidated revenues of Euro 380.5 million (+18.6% on 2020, +12.5% at like-for-like consolidation scope);

- Heating Division sales of Euro 298.3 million (+19.8% on 2020);

- Metering Division sales of Euro 76.9 million (+12.1% on 2020), including Smart Gas Metering sales of Euro 57.1 million and Water Metering sales of Euro 19.8 million;

- Consolidated EBITDA of Euro 51.2 million (+17.4% on the previous year);

- Adjusted consolidated net profit of Euro 16.3 million (+21.6%, 4.3% margin), compared to Euro 13.4 million in 2020 (4.2% margin);

- Operating cash flow of Euro 27.2 million, after investments of Euro 26.1 million;

- Net financial position of Euro 106.7 million (Euro 116.0 million at end of 2020).

The Q4 2021 results report:

- Consolidated revenues of Euro 94.3 million (in line with Q4 2020, -4.2% at like-for-like consolidation scope);

- Heating Division Sales of Euro 77.4 million (+3.6% on Q4 2020);

- Metering Division Sales of Euro 14.9 million (-17.5% on Q4 2020), including Smart Gas Metering sales of Euro 10.4 million and Water Metering sales of Euro 4.5 million;

- Consolidated EBITDA of Euro 9.3 million, compared to Euro 11.2 million in Q4 2020.

Proposed distribution of a dividend of Euro 0,30 per share.

Shareholders’ Meeting called for April 29, 2022

***

Padua, March 22, 2022 – The Board of Directors of SIT S.p.A., listed on the Euronext Milan, at today’s meeting chaired by Federico de’ Stefani, Chairman and Chief Executive Officer, approved the 2021 results and called the Company’s Shareholders’ Meeting, in ordinary session, for April 29, 2022, in single call.

“The 2021 results reflect for our stakeholders a highly-performing company, with excellent numbers which meet expectations and highlight the strength of our business model” stated SIT’s Chairperson and CEO, Federico de’ Stefani. “Despite material price rises and procurement difficulties, we have responded well to customer demands, quickly reacting to varying needs.

Our commitment to the energy transition continues unabated. Gas price rises have inevitably sped up the transition to renewable sources and raised awareness on the protection of natural resources. Benefitting from a green economy approach introduced many years ago, all our products are already bio-methane compatible and the development of hydrogen-ready solutions continues apace, some of which have already completed their certification and are ready for the market. Water, like hydrogen will be key to this development: with Janz, the Metering division is working on developing technologically-advanced and connected meters which limit waste, with a view to growing international market share.

In a 2022 experiencing the same challenges as 2021, amid heightening political tensions whose impacts on the business are still unclear, SIT can rely on strong regional diversification, both in terms of procurement and production and marketing. This – underlines de’ Stefani – is a key group strength, which, together with strong and clear Governance, allows us to offset this risk and ensure constant control. Against this backdrop, our priority remains the market and our customers: we seek to ensure, in fact, an uninterrupted service, which is on time and always of the highest quality, acting flexibly and on a global basis on the supply chain in order to protect procurement.”

KEY FINANCIALS

| (Euro.000) | 2021 | % | 2020 | % | change % |

| Revenues from contracts with customers | 380,521 | 100.0% | 320,731 | 100.0% | +18.6% |

| Adjusted EBITDA (1) | 51,215 | 13.5% | 44,600 | 13.9% | +14.8% |

| EBITDA | 51,215 | 13.5% | 43,621 | 13.6% | +17.4% |

| EBIT | 24,330 | 6.4% | 19,616 | 6.1% | +24.0% |

| Earnings before taxes (EBT) | 11,706 | 3.1% | 15,991 | 5.0% | -26.8% |

| Net profit | 8,243 | 2.2% | 13,225 | 4.1% | -37.7% |

| Adjusted net profit (2) | 16,311 | 4.3% | 13,409 | 4.2% | +21.7% |

| Operating cash flows, adjusted (3) | 27,198 | 14,586 |

(1) Net of M&A charges in 2020 of Euro 1.0 million

(2) Net of non-recurring charges and income and fair value accounting of Warrants

(3) Net of cash flows for M&A’s in 2020 of Euro 28.4 million

| (Euro.000) | 31/12/2021 | 31/12/2020 | |

| Net financial position | 106,729 | 116,021 | |

| Net trade working capital | 45,423 | 49,817 | |

| Net trade working capital/Revenues | 11.9% | 15.5% |

Sales performance

2021 consolidated revenues were Euro 380.5 million, increasing 18.6% on 2020 (Euro 320.7 million). The 2021 figures include the sales of Janz, the Portuguese Water Metering company acquired at the end of 2020, which in the first year of consolidation reported sales of Euro 19.8 million.

| (Euro.000) | 2021 | % | 2020 | % | diff | diff % |

| Heating | 298,251 | 78.4% | 249,003 | 77.6% | 49,248 | 19.8% |

| Metering | 76,913 | 20.2% | 68,634 | 21.4% | 8,279 | 12.1% |

| Total sales | 375,164 | 98.6% | 317,637 | 99.0% | 57,527 | 18.1% |

| Other revenues | 5,357 | 1.4% | 3,094 | 1.0% | 2,263 | 73.1% |

| Total revenues | 380,521 | 100% | 320,731 | 100% | 59,790 | 18.6% |

| (Euro.000) | 2021 | % | 2020 | % | diff | change % |

| Italy | 106,993 | 28.1% | 107,654 | 33.6% | (622) | (0.6%) |

| Europe (excluding Italy) | 167,497 | 44.0% | 128,827 | 40.2% | 38,670 | 30.0% |

| The Americas | 74,241 | 19.5% | 58,537 | 18.3% | 15,704 | 26.8% |

| Asia/Pacific | 31,791 | 8.4% | 25,712 | 8.0% | 6,078 | 23.6% |

| Total revenues | 380,521 | 100% | 320,731 | 100% | 59,790 | 18.6% |

Heating Division sales in 2021 amounted to Euro 298.3 million, +19.8% compared to Euro 249.0 million in 2020 (+20.2% at like-for-like exchange rates). In the fourth quarter, the division’s core sales rose 3.6% to Euro 77.4 million, compared with Euro 74.7 million in the same period of 2020.

The following table presents Heating Division core sales by region according to management criteria:

| (Euro.000) | 2021 | % | 2020 | % | diff | change % |

| Italy | 55,682 | 18.7% | 43,945 | 17.6% | 11,737 | 26.7% |

| Europe (excluding Italy) | 140,078 | 47.0% | 120,213 | 48.3% | 19,865 | 16.5% |

| The Americas | 72,025 | 24.1% | 57,960 | 23.3% | 14,065 | 24.3% |

| Asia/Pacific | 30,467 | 10.2% | 26,885 | 10.8% | 3,581 | 13.3% |

| Total sales | 298,251 | 100% | 249,003 | 100% | 49,248 | 19.8% |

Italian sales were up 26.7% on 2020, thanks to strong Central Heating demand, supported also by incentives; mechanical controls rose (Euro +5.7 million, +27.5%), as did fans (Euro +5.6 million, +38.2%) and flue kits (Euro +0.8 million, +40.0%).

Europe (excluding Italy) in 2021 saw sales increase 16.5% on the previous year, for a total of Euro 140.1 million. All regions report improvements on 2020; Turkey in particular, the leading market with 11.8% of division sales, saw growth of 20.4% (Euro +6.0 million), thanks to recovering Central Heating demand from multi-national customers in the country, while the UK, 7.5% of division sales, was up 6.2% on an annual basis (Euro 1.3 million). Central European remains strong, thanks to the introduction of new products, up 26.7% on 2020 (Euro 6.4 million).

Sales in the Americas rose 24.3% (+27.7% at like-for-like exchange rates), thanks to fireplaces growth, with a strong recovery on a 2020 shaped by COVID; in 2021, Storage Water Heating applications contracted 6.1% (-4.0% at like-for-like exchange rates) due to a number of shipment delays in Q4.

Asia/Pacific sales were up 13.3% to Euro 30.5 million (Euro 26.9 million in 2020). Growth was reported in China (6.5% of the division), up 32.3% as a result of the Central Heating retail market recovery and in Australia, improving Euro 1.1 million (+18.2%).

Among the main product families, Mechanical controls sales were up (+18.1%, Euro 26.7 million), as were Fans (+31.2%, Euro 8.8 million) and Electronic controls (+17.7%, Euro 8.3 million). At the application segment level, Central Heating accounted for 59.7% of division sales, increasing 20.0%, while Direct Heating (17.5% of the division sales) rose 35.0% due to the strong fireplaces market.

The Metering Division in 2021 reports sales of Euro 76.9 million (+12.1%), including those of Janz (Water Metering enterprise acquired at the end of December 2020) of Euro 19.8 million.

Smart Gas Metering sales in 2021 totalled Euro 57.1 million, compared to Euro 68.6 million in 2020 (-16.7%). This performance, as forecasted, was due to the contraction of the Italian market in view of the advanced phase of the initial replacement of installed meters, which is over 80% completed. Overseas sales accounted for approx. 7% of the total and were mainly in Greece and Croatia. Commercial & Industrial sales rose considerably (+39.6%) following the introduction of the new generation of products and due to the overseas contribution.

Looking to the Water Metering division, this new Group operating segment, following the acquisition of the Portuguese Janz at the end of December 2020, reported in its first year of operations sales of Euro 19.8 million. The sales concerned finished meters for Euro 9.3 million and components for Euro 9.1 million.

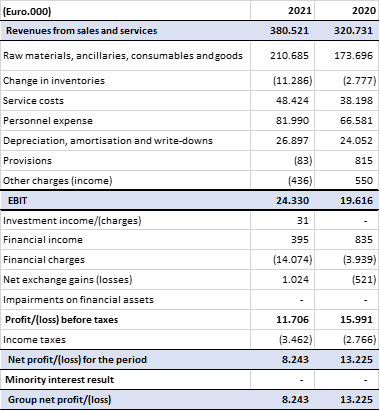

Operating performance

Consolidated revenues in 2021 totalled Euro 380.5 million, increasing 18.6% on 2020 (Euro 320.7 million).

The purchase of raw materials and consumables, including changes in inventories, totalled Euro 199.4 million, accounting for 52.4% of revenues, decreasing on 53.3% in 2020, despite the increases in raw materials, demonstrating the Group’s ability to absorb these supply cost increases, also through higher sales prices to customers.

Service costs of Euro 48.4 million accounted for 12.7% of revenues, compared to 11.9% in the previous year (Euro 38.2 million). These cost increases reflect higher transport costs (Euro 4.0 million), in particular on purchases and the greater use of outsourcing (Euro 1.6 million). The increase in consultancy (+29.7%) on the previous year mainly concerns product technical consultancy.

Personnel costs totalled Euro 82.0 million, accounting for 21.5% of revenues (20.8% in 2020), increasing Euro 15.4 million. This increase is due for Euro 5.6 million to the expansion of the Group’s scope, with the inclusion of the subsidiary Janz and for Euro 2.5 million the greater use of temporary personnel (service which was reduced in 2020 in view of the COVID impact).

Amortisation, depreciation and write-downs of Euro 26.9 million were up 11.8% on the previous year (Euro 24.1 million). The increase is mainly due to greater capex in 2021 than the previous year, in addition to the impact of the PPA related to the acquisition of Janz.

EBITDA was Euro 51.2 million, up 17.4% on 2020 (Euro 43.6 million). Non-recurring costs were incurred in 2020 totalling Euro 1.0 million related to the acquisition of Janz.

Group EBIT therefore rose from Euro 19.6 million in 2020 to Euro 24.3 million in 2021 (+24.0%), with a 6.4% margin, increasing from 6.1%.

Financial charges totalled Euro 14.1 million, rising Euro 10.1 million on the previous year. This account includes Euro 9.0 million for the increase in the fair value of the Warrants and extraordinary charges related to refinancing transactions of Euro 1.0 million.

Adjusted net financial charges, i.e. net of the above corporate transactions and fair value changes, in 2021 totalled Euro 3.7 million (in line with the previous year).

Income taxes totalled Euro 3.1 million, compared to Euro 2.8 million in 2020. This amount is net of the positive effect from non-recurring income (Euro 1.7 million) relating to the agreement with the Tax Agency on the calculation of the financial contribution of intangible assets (Patent Box optional regime), in addition to the reduction in the pre-tax result on the previous year.

The net profit was Euro 8.2 million (Euro 13.2 million in 2020).

The adjusted net profit, net of the above-stated non-recurring effects, was Euro 16.3 million (4.3% margin), compared to Euro 13.4 million in 2020 (4.2% margin).

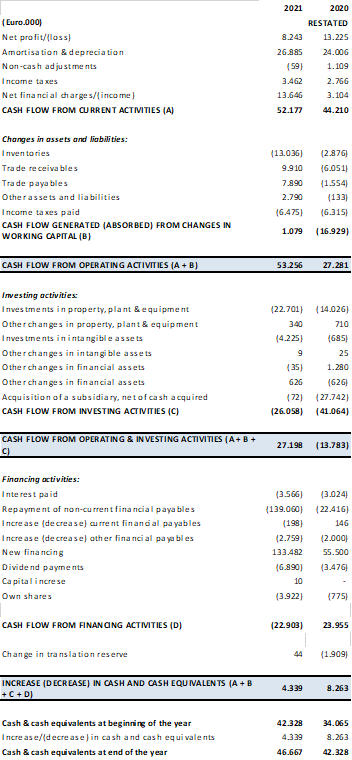

Cash Flow

Cash flows in the year were as follows:

| (Euro.000) | 2021 | 2020 | |

| Cash flow from current activities (A) | 52,177 | 44,210 | |

| Cash flow generated (absorbed) from Working Capital (B) | 1,079 | (16,929) | |

| CASH FLOW FROM OPERATING ACTIVITIES (A + B) | 53,256 | 27,281 | |

| Cash flow from investing activities (C) | (26,058) | (41,064) | |

| CASH FLOW FROM OPERATING & INVESTING ACTIVITIES (A + B + C) | 27,198 | (13,783) | |

| Interest paid | (3,576) | (3,024) | |

| Changes in accrued interest, MTM and amortised cost | (527) | (203) | |

| Equity changes | (3,868) | (2,684) | |

| Changes to financial assets | (500) | 1,000 | |

| Changes in payables for acquisitions | 446 | (3,570) | |

| Dividends paid | (6,890) | (3,476) | |

| IFRS 16 | (2,991) | (11,902) | |

| Change in net financial position | 9,292 | (37,642) | |

| Opening net financial position | 116,021 | 78,379 | |

| Closing net financial position | 106,729 | 116,021 |

Operating cash flows in 2021 amounted to Euro 52.2 million, compared to Euro 44.2 million in the previous year.

Cash flows from working capital movements amounted to Euro 1.1 million in 2021 compared to an absorption of Euro 16.9 million in 2020. Commercial working capital generated Euro 4.8 million in 2021 due to an increase in current payables and the without recourse factoring of trade receivables. Inventory increased by Euro 13.0 million in the year. Tax liabilities remained substantially in line with 2020, while other working capital items generated a cash flow of Euro 2.8 million.

In terms of investments, in 2021 cash investments of Euro 26.1 million were made, compared to Euro 41.1 million in 2020, including the acquisition of JANZ, the Portuguese water metering enterprise and of Plast Alfin, a Tunisian plastics manufacturing company, for a total outlay of Euro 28.4 million.

In 2021, operating cash flows after investments therefore amounted to Euro 27.2 million, compared to Euro 14.6 million in the previous year, before M&A’s.

Among the financing activity cash flows, in 2021 we indicate the payment of interest for Euro 3.5 million (Euro 3.0 million in 2020), and the payment of dividends for Euro 6.9 million in 2021 (Euro 3.5 million in 2020).

Finally, it should be noted that the change in net debt due to the application of IFRS 16 results in an increase of Euro 3.0 million in 2021, primarily due to new leases.

At December 31, 2021, the net financial debt was Euro 106.7 million, compared to Euro 116.0 million at December 31, 2020, improving by Euro 9.3 million.

Subsequent events

With regards to the political situation arising from the invasion of Ukraine by the Russian army, the impacts on SIT group operations are being continually monitored.

2021 revenues directly from Russia and Ukraine totalled approx. 5% of consolidated revenues and concerned only the Heating Division.

The group does not hold direct investments in the two countries. Commercial coverage is provided by local distributors managed by employees of the group’s Czech subsidiary based in Moscow.

On the procurement side, a supplier of electronic board assembly belonging to an American multinational company is based in Ukraine, on the Slovak border. The boards provided are used in Heating and now represent approx. 25% of the Division’s total. This supply currently continues uninterrupted. However, SIT has initiated a contingency plan to accelerate insourcing and the shifting of production to suppliers located in other low-cost countries.

Finally, in March 2022, SIT agreed a loan with Cassa Depositi e Prestiti S.p.A. for Euro 15 million in order to support new environmental, energy efficiency, sustainable development promotion and green economy investment and to launch initiatives to grow the Group in Italy and overseas.

Outlook

Tensions on both prices and the availability of raw materials and electronic components continued into the initial months of 2022, alongside the ongoing political and economic uncertainty from the Russia/Ukraine crisis.

Due to the situation of increased uncertainty, it is not appropriate to provide precise forecasts for the 2022 operating-financial performance.

However, SIT remains confident in the positive fundamental trends on which its growth and its market and technology leadership are based: the energy transition towards lower emissions and hydrogen-ready solutions, energy efficiency supported also by incentives, the optimisation of water consumption through new metering systems, the replacement of gas meters for the domestic market and the group’s ability to pass on to customers the cost increases resulting from the new inflationary environment.

Dividend payment proposal

The Board of Directors approved the proposal to the Shareholders’ Meeting to distribute a dividend of Euro 0,30 per share, establishing the ex date as May 9, 2022, the record date as May 10, 2022 and the payment date as May 11, 2022.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company.

This press release and the results presentation for 2021 are available on the website www.sitcorporate.it in the Investor Relations section.

***

Today at 3PM, SIT management will hold a conference call to present to the financial community and the press the 2021 consolidated results.

You may participate in the conference call by connecting to the following link: meet.google.com/qyr-guxt-hhr

The support documentation shall be published in the “Investor Relations” section on the company website (www.sitcorporate.it) before the conference call.

***

Annex 1

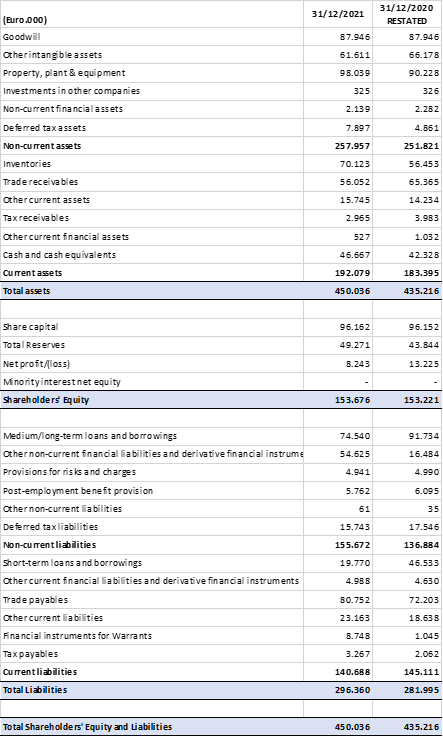

BALANCE SHEET

Annex 2

INCOME STATEMENT

Annex 3

CASH FLOW STATEMENT