Highlights

SIT in H1 2023 returned:

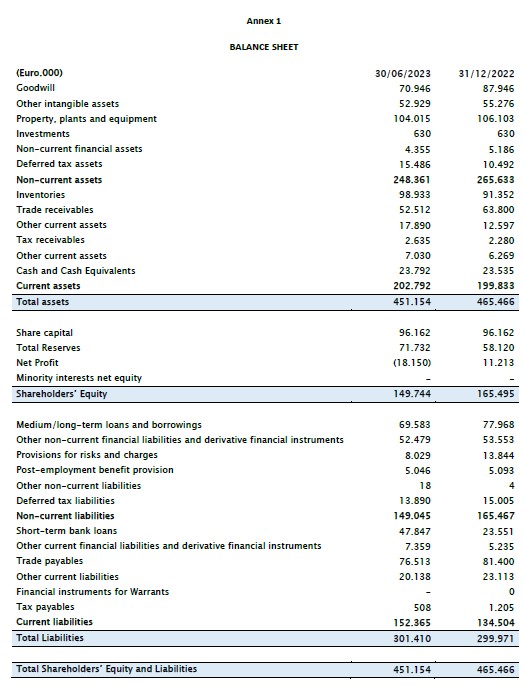

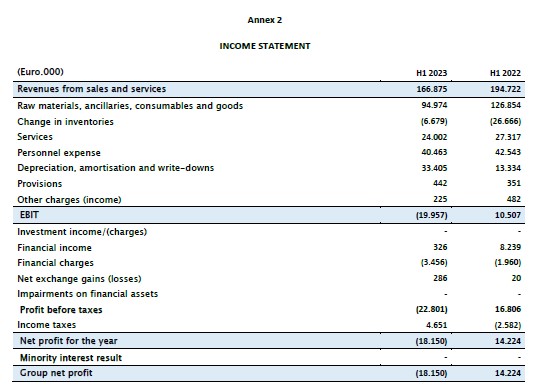

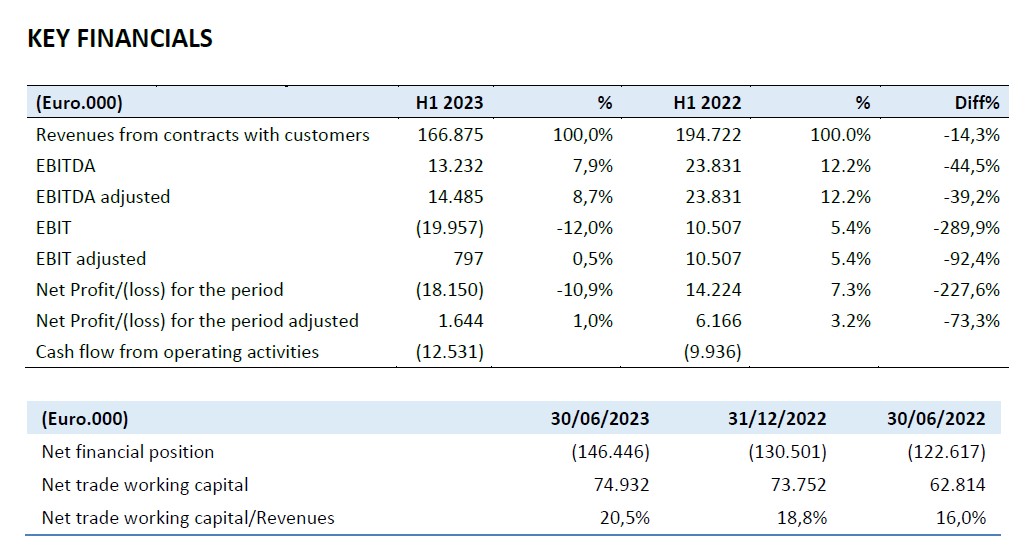

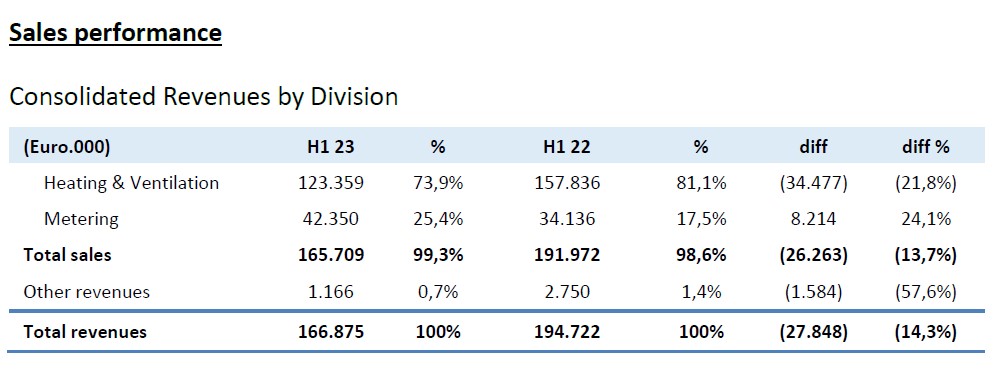

- Consolidated revenues of Euro 166.9 million (-14.3% on H1 2022);

- Heating&Ventilation Division sales of Euro 123.4 million (-21.8% on H1 2022);

- Metering Division Sales of Euro 42.4 million (+24.1% on H1 2022), including Smart Gas Metering sales of Euro 29.5 million (+36.2%) and Water Metering sales of Euro 12.8 million (+2.9%);

- Consolidated Adjusted EBITDA of Euro 14.5 million (-39.2% on H1 2022);

- Consolidated adjusted net profit of Euro 1.6 million (1.0% margin), compared to Euro 6.2 million in H1 2022 (3.2% margin);

- Write-down of Heating & Ventilation goodwill for Euro 17.0 million based on sector outlook;

- Consolidated net result reports a loss of Euro 18.2 million (profit of Euro 14.2 million in H1 2022);

- Operating cash flow of Euro -12.5 million in H1 2023, after investments of Euro 11.3 million;

- Net financial position of Euro 146.4 million (Euro 122.6 million at June 30, 2022).

Q2 2023 reports:

- Consolidated revenues of Euro 83.3 million (-17.4% on Q2 2022);

- Heating & Ventilation Division sales of Euro 60.7 million, -25.8% on Q2 2022;

- Metering Division sales of Euro 22.0 million (+24.9% on Q2 2022), including Smart Gas Metering sales of Euro 15.8 million (+39.1%) and Water Metering sales of Euro 6.1 million (-1.2%);

***

Padua, September 29, 2023 – Today the Board of Directors of SIT S.p.A., listed on the Euronext Milan segment of the Italian Stock Exchange, in a meeting presided over by Federico de’ Stefani, the Chairperson and Chief Executive Officer, approved the consolidated H1 2023 results.

Federico de’ Stefani, Chairperson and CEO of SIT stated:

“The first half-year figures reflect substantially divergent performances for each of the Group’s two business areas. While the Metering division saw sustained growth, the historic core business slowed significantly. This performance should be considered in view of end Heating market developments: the significant cut in green building incentives – mainly the so-called ‘superbonus’ – the consecutive boiler regulation announcements leading to the “boiler ban”, which has now entirely been called into question, alongside the high levels of inflation and interest rates, have impacted consumption and therefore consumer demand. These developments have extended supply chain destocking timeframes more than expected, with heat pump timeframes, for example, now as long as those for boilers.

The Metering business confirms growth for the first six months and going forward. We are currently working on a number of projects with major impact to drive international expansion and value generation.

SIT’s Management is focused on introducing cost containment measures, including on overheads, with results to emerge from 2024, and on positioning the Group in the higher growth potential and cash generation segments.”

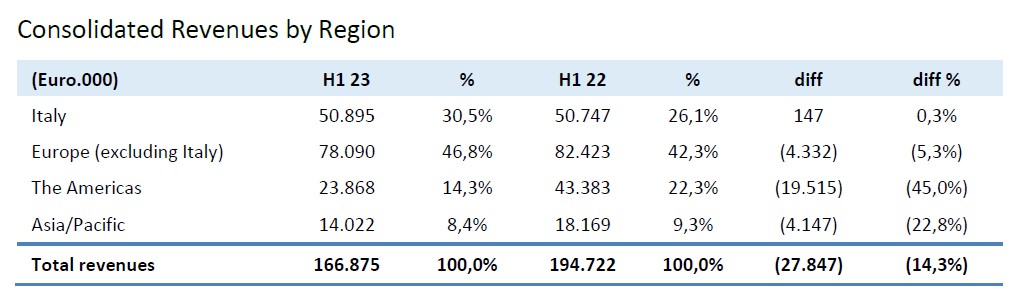

H1 2023 consolidated revenues were Euro 166.9 million, decreasing 14.3% on the same period of 2022 (Euro 194.7 million).

Heating & Ventilation Division

Heating & Ventilation Division sales in H1 2023 totalled Euro 123.4 million, -21.8% on Euro 157.8 million for the same period of 2022 (-21.8% also at like-for-like exchange rates).

The Division in the second quarter returned sales of Euro 60.7 million, decreasing 25.8% on Q2 of the previous year (Euro 81.8 million).

The Heating consumer market significantly contracted in the second quarter of 2023. All application technologies, both boilers and heat pumps, were affected by this development, which in the quarter saw a contraction of 17.3% on the same period of the previous year, with boilers down 19.8% (See EHI – European Heating Industry, H1 market statistics). The underlying reasons stem from the uncertain legislative framework both in terms of energy transition incentives and regarding the effect of announcements on future restrictions on certain technologies such as gas boilers. The impact of inflation and high interest rates on household spending capacity also had an impact.

Against this market backdrop, SIT’s customers are still operating with substantial stock levels due to the 2022 demand dynamics and those built up in the past to deal with supply chain uncertainties (particularly for electronics).

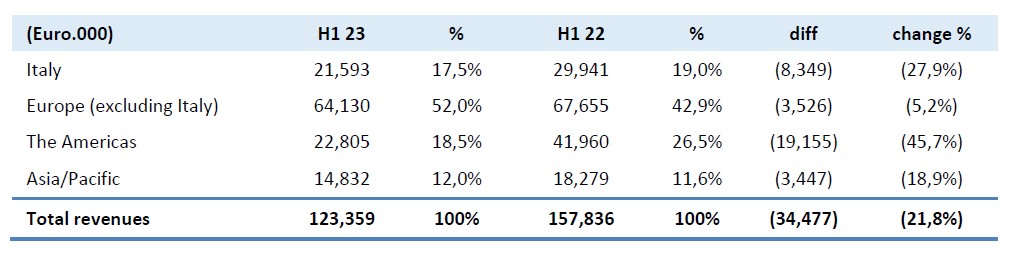

The following table presents Heating & Ventilation Division core sales by region according to management criteria:

Italian sales decreased 27.9% on the first half of 2022. This contraction was seen across all the main products and reflects the changes to sector incentives, in addition to the slowdown of the home renovation market. We highlight the particularly weak performance of the Pellet Stoves applications (-70%) in the Direct Heating segment, which in 2022 benefited from the significant increase in the price of the gas.

Sales in Europe (excluding Italy) decreased Euro 3.5 million in H1 2023 (-5.2%) on the same period of the previous year. Turkey, the top shipping market with 18.9% of division sales, grew 51.3% (Euro 7.9 million), particularly thanks to Fans for Central Heating applications, impacted by supplier difficulties in H1 2022; the UK, with 8.1% of division sales, grew 5.2% on H1 2022, thanks to the strong second quarter performance (+14.8%), particularly for flues. The Central Europe result was substantially in line with the division as a whole (-22.5%), with Heat Recovery Units sales up Euro 1.7 million, +34% on the same period of 2022.

Sales in the Americas contracted 45.7% (-46.8% at like-for-like exchange rates). The reduction affected Water Heating Storage for Euro 8.0 million, while the Direct Heating applications of fireplaces (-Euro 11.3 million, -52.5%) were impacted by the poor new constructions performance to which this segment is linked.

Asia/Pacific contracted 18.9% (-15.6% at like-for-like exchange rates), with sales of Euro 14.8 million in the period (Euro 18.3 million in H1 2022). Chinese sales in the second quarter contracted 8.2% on the same period of 2022, resulting in a 16.5% reduction in sales for the first half of the year to Euro 9.0 million (7.3% of division sales). Australia in the first half of 2023 reported sales of Euro 3.3 million, decreasing 21.1% in view of the general sector and economic performance.

Metering Division

Metering Division sales were Euro 42.4 million (Euro 34.1 million, growing 24.1% on the same period of the previous year).

In H1 2023, sales in the Smart Gas Metering sector totaled Euro 29.5 million, increasing 36.2% on the first half of 2022. The performance was due to the Group’s strong positioning on the Italian market and the new development and replacement projects launched by the major clients. Sales in Italy accounted for 94.0% of the total, while overseas sales accounted for 6.0% (from Greece and Central Europe).

Water Metering sales totalled Euro 12.8 million, up 2.9% on H1 2022. Portugal accounts for 17.3% of sales, Spain for 35.6%, the rest of Europe for 36.3% and America and Asia respectively for 7.7% and 2.8%.

Operating performance

H1 2023 consolidated revenues were Euro 166.9 million, decreasing 14.3% on the same period of 2022 (Euro 194.7 million).

Adjusted EBITDA of Euro 14.5 million decreased 39.2% on the same period of the previous year (Euro 23.8 million) and was impacted by volumes, particularly in the Heating & Ventilation division, which was only partially offset by the Metering division and the cost streamlining and containment actions.

EBIT net of non-recurring charges and the write-down of assets (Adjusted EBIT) was Euro 0.8 million (0.5% of revenues), compared to Euro 10.5 million (5.4% of revenues) in H1 2022.

The write-down of goodwill of Euro 17.0 million was made in view of the trend and the outlook for the use of domestic gas boilers as a result of the energy transition.

Group EBIT was particularly impacted by the write-down from the impairment test and reduced from a profit of Euro 10.5 million for the first half of 2022 to a loss of Euro 20.0 million for the first half of 2023.

Net financial charges in the first half of 2023 totalled Euro 3.1 million, compared to net financial income of Euro 6.3 million for the same period of the previous year. This was impacted in the first half of 2022 by the change in the fair value based on the market value of the Warrants, which resulted in financial income of Euro 8.1 million.

Adjusted net financial charges, net therefore of the above-stated non-recurring components, in H1 2023 totalled Euro 3.1 million, compared to Euro 1.8 million in the same period of the previous year.

Income taxes were a net positive amount of Euro 4.7 million and reflect the accrual of deferred tax assets deriving from the recoverable tax losses matured by a number of overseas companies.

The net result for the period was a loss of Euro 18.2 million, compared to a profit of Euro 14.2 million for the same period of 2022.

The adjusted net result, net of the non-recurring effects and write-downs of assets described above, was Euro 1.6 million (1.0% margin), compared to Euro 6.2 million (3.2%) in the same period of 2022.

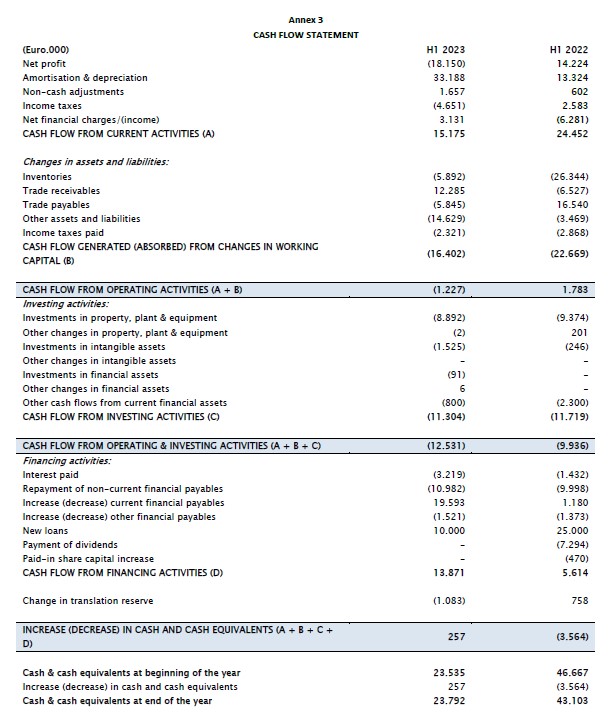

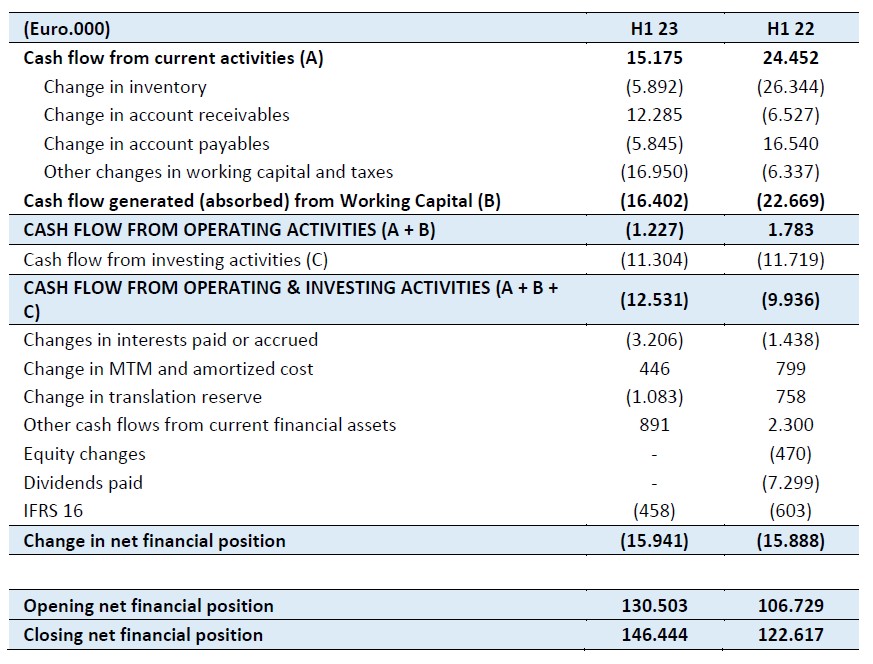

Cash Flow performance

The net financial debt at June 30, 2023 was Euro 146.4 million, compared to Euro 130.5 million at December 31, 2022 and Euro 122.6 million at June 30, 2022.

The movements in the net financial position are reported below:

Operating cash flows of Euro 15.2 million were generated in the first half of 2023, compared to Euro 24.5 million in the same period of 2022.

Working capital of Euro 16.4 million was absorbed in the first half of 2023, compared to Euro 22.7 million. We highlight in the first quarter of 2023 the outlay following the agreement reached in Q3 2022 in terms of the non-recurring dispute with a customer.

Commercial working capital in the first half of 2023 was substantially in line with the beginning of the year, with Smart Gas Metering inventories increasing to deal with the backlog in the second half of the year, while other commercial working capital items have developed in line with the reducing Heating & Ventilation segment volumes. In the same period of 2022, commercial working capital absorbed Euro 16.3 million, particularly in terms of Heating & Ventilation inventories as a result of the expected sales volumes.

Investing activities absorbed cash of Euro 11.3 million, compared to Euro 11.7 million in 2022.

Cash flows from operating activities after investments of Euro 12.5 million were therefore absorbed in the period, compared to an absorption of Euro 9.9 million in the preceding period.

In terms of financial activities cash flows, we highlight in the period interest of Euro 3.2 million, compared to Euro 1.4 million in the same period of 2022.

In view of the financial results for the period, SIT drew up a prior waiver request for its main lenders in terms of the June 30, 2023 covenants regarding the net financial position on EBITDA. This waiver was granted with acceptance letter dated June 30, 2023.

Subsequent events

SIT in July announced the incorporation of the company Hybitat S.r.l. with the goal of creating an innovative hydrogen generation and storage system for residential use. The initiative, with SIT having a 20% stake, is undertaken with a technology partner, e-Novia, listed on the Euronext Milan and operating in the sustainable mobility sector, with expertise in deep tech innovation and which holds a 20% stake as well, alongside other expert key technology operators.

Electricity storage is a crucial element in creating a more sustainable economy; by 2040 the total potential market for Long Duration Energy Storage may equate to 10% of all electricity consumed.

Outlook

In terms of the outlook, typical Heating & Ventilation sector seasonality shall not be apparent in the remaining part of 2023 and for which a further significant slowdown is expected.

The good growth outlook for the Smart Gas Metering sector of the Metering division is confirmed, benefiting from a strong competitive positioning on the domestic market, while the Water Metering growth in the first half of 2023 is expected to slow slightly on expectations, although with 10-15% growth forecast on the previous year.

At consolidated level, the sales forecasts are expected to be further reduced on the first half of the year.

In terms of margins, the operating costs and general expenses streamlining and containment actions are being implemented also through structural operations on the organization whose impacts shall materialise from 2024. The EBITDA margin net of non-recurring transactions is expected to be lower than double-digits for the current year.

The net financial position at December 31, 2023 is expected to be substantially in line with June 30, 2023.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for the period are available on the website www.sitcorporate.it/en in the Investor Relations section.

Today at 4PM CEST, SIT management will hold a conference call to present to the financial community and the press the Q1 2023 consolidated results. You may participate in the conference call by connecting to the following link: https://shorturl.at/dfiKV

The support documentation shall be published in the “Investor Relations” section on the company website (www.sitcorporate.it) before the conference call.