SIT reports for 9M 2021:

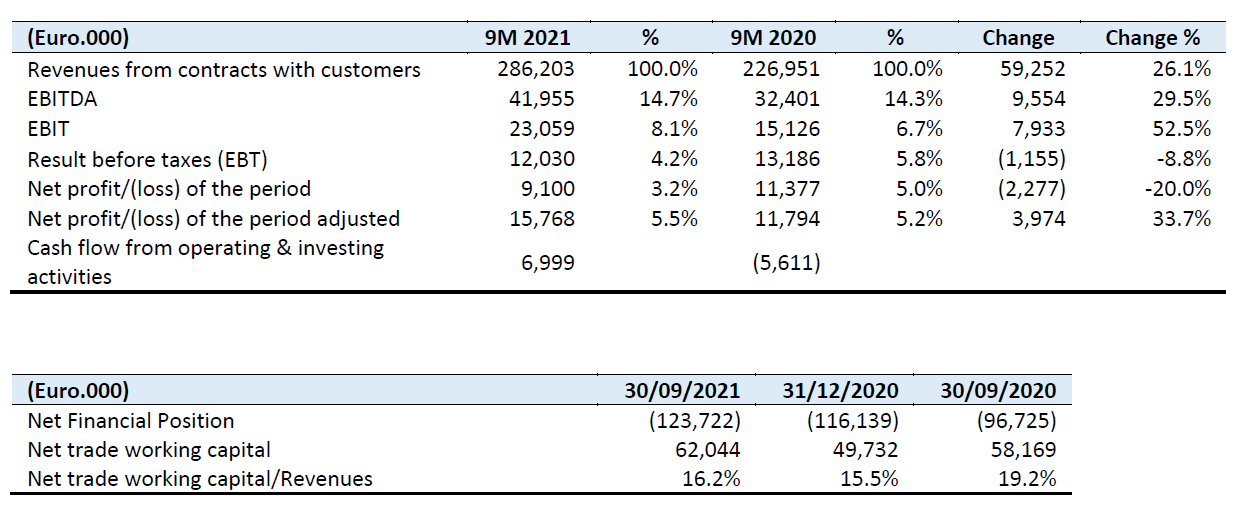

- Consolidated revenues of Euro 286.2 million (+26.1% on the same period of 2020, +19.4% at like-for-like consolidation scope);

- Heating Division Sales of Euro 220.9 million (+26.7% on 9M 2020);

- Metering Division Sales of Euro 62.0 million (+22.6% on 9M 2020), including Smart Gas Metering sales of Euro 46.7 million and Water Metering sales of Euro 15.3 million;

- Consolidated EBITDA of Euro 42.0 million (+29.5% on 9M 2020);

- Adjusted consolidated net profit of Euro 15.8 million (5.5% margin), compared to Euro 11.8 million in 9M 2020 (5.2% margin);

- Operating cash flow of Euro +7.0 million, after investments of Euro 19.6 million;

- Net financial position at September 30, 2021 of Euro 123.7 million (Euro 116.1 million at end of 2020).

Q3 2021 reports:

- Consolidated revenues of Euro 96.0 million (+2.5% on Q3 2020, -3.2% at like-for-like consolidation scope);

- Heating Division Sales of Euro 76.2 million (+9.4% on Q3 2020);

- Metering Division Sales of Euro 18.8 million (-19.5% on Q3 2020), including Smart Gas Metering sales of Euro 13.5 million and Water Metering sales of Euro 5.3 million;

- Consolidated EBITDA of Euro 13.1 million, compared to Euro 17.2 million in Q3 2020.

***

Padua, November 10, 2021

The Board of Directors of SIT S.p.A., listed on Euronext Milan, in a meeting today presided over by Federico de’ Stefani, the Chairman and Chief Executive Officer, has approved the consolidated 9 months 2021 results.

“In the first nine months of 2021 we confirmed growth in foreign markets driven by the Heating and Water Metering business” stated de’ Stefani. “The uncertainty and volatility issues regarding supply chain were addressed by an international team who managed to mitigate the impact of shortages on production and shipments. Over the coming months, as this situation persists, the contribution provided by this team continues to be fundamental. We have consistently invested time and resources in supporting research and development to maintain our leadership and make our contribution to the energy transition. It is with great satisfaction that MeteRSit – a group company which develops and manufactures smart gas meters – has attended the COP26 conference with the UK Government’s Department of Economic Development, Energy and Business Department (BEIS), and with whom we have been working closely in the development of devices utilising hydrogen for residential use”.

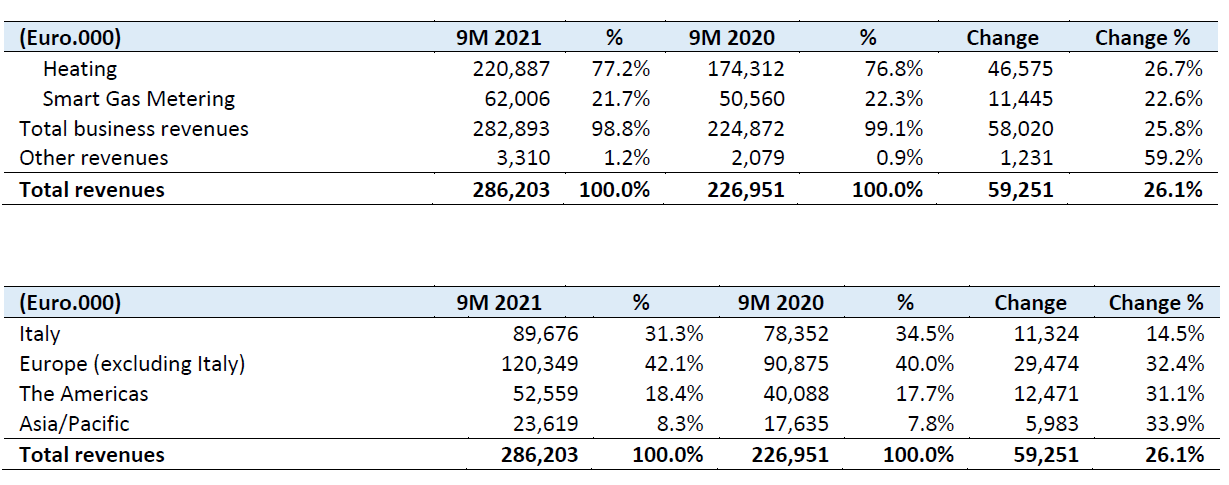

KEY FINANCIALS

9M 2021 consolidated revenues were Euro 286.2 million, increasing 26.1% on the same period of 2020 (Euro 227.0 million). The 2021 figures include the sales of Janz, the Portuguese Water Metering company acquired at the end of 2020 and reporting sales of Euro 16.1 million for the first nine months of 2021.

Heating Division sales in the first nine months of 2021 amounted to Euro 220.9 million, +26.7% compared to Euro 174.3 million in the same period of 2021 (+28.2% at like-for-like exchange rates). In the third quarter, the division’s core sales rose 9.4% to Euro 76.2 million compared with Euro 69.6 million in the same period of 2020, reflecting strong market demand supported by the positive impact of incentives.

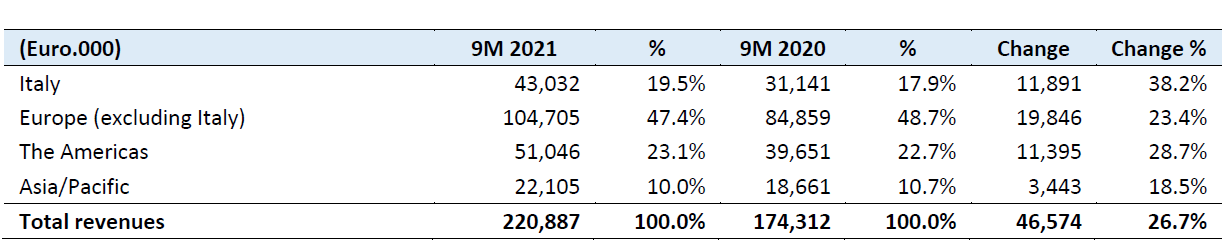

The following table presents Heating Division core sales by region:

Italian sales were up 38.2% on 9M 2020. Recovering Central Heating demand supported this improvement, in addition to incentives; we highlight the increase for mechanical controls (+Euro 5.8 million, +39.0%), for fans (+Euro 5.5 million, +53.3%) and for flue kits (+Euro 0.6 million, +43.0%).

European sales (excluding Italy) in 9M 2021 rose 23.4% on the same period of the previous year to Euro 104.7 million. All regions report improvements on 9M 2020; Turkey in particular, the leading market with 12.1% of division sales, saw growth of 32.2% (Euro +6.5 million), thanks to recovering Central Heating demand from multinational customers in the country, while the UK, 7.5% of division sales, was up 18.3% (Euro 2.6 million). The central European markets performed well, thanks to the launch of new products.

Sales in the Americas were up 28.7% (+36.3% at like-for-like exchange rates), thanks both to the growth in sales for Storage Water Heating applications and the good fireplace performance, recovering strongly on the same period of the previous year.

Asia/Pacific sales were up 18.5% to Euro 22.1 million (Euro 18.7 million in 9M 2020). Growth was achieved both in China (6.4% of the division), with a 42.8% recovery of the retail market in the Central Heating segment, and in Australia, which reported an increase of Euro 1.1 million (+24.0%).

The Metering Division reports for 9M 2021 sales of Euro 62.0 million (+22.6%), including those of Janz (Water Metering enterprise acquired at the end of December 2020) of Euro 15.3 million in the period.

Smart Gas Metering sales for 9M 2021 totalled Euro 46.7 million (Euro 50.6 million in the same period of 2020 (-7.6%)). In the first nine months of 2021, sales for Residential Meters totalled Euro 42.8 million (91.7% of total sales), while sales for Commercial & Industrial Meters amounted to Euro 3.6 million.

In the first nine months of 2021, overseas sales totalled Euro 3.6 million (7.6% of the total), compared to Euro 1.2 million in the same period of 2020 (2.4% of the total).

Looking at the Water Metering division, the group’s new operating segment, following the acquisition of the Portuguese Janz at the end of December 2020, reported 9M 2021 sales of Euro 15.3 million. These sales regarded finished meters for Euro 7.7 million and components for Euro 7.6 million.

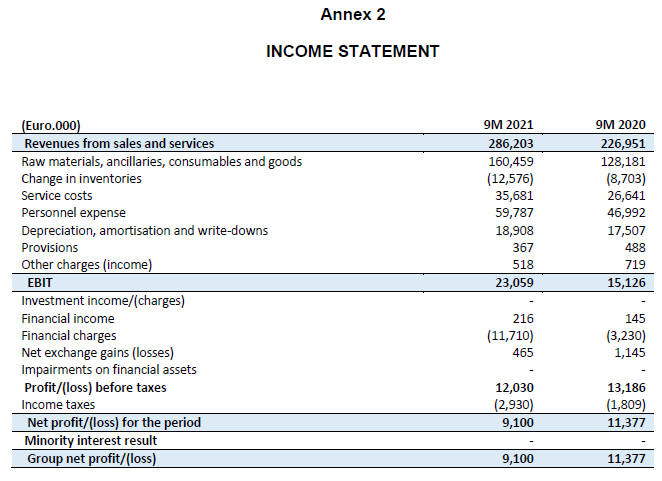

9M 2021 EBITDA was Euro 42.0 million, compared to Euro 32.4 million in the previous year (respectively 14.7% and 14.3% margins). The 9M 2021 performance reflects the increased volumes, particularly with regards to the Heating Division, and the greater contribution of the water metering business acquired at the end of 2020. Prices also increased, facilitating the transfer to the sales market of the higher raw material and component costs incurred. Q3 EBITDA was Euro 13.1 million (13.6% margin), while amounting to Euro 17.2 million in the same period of 2020 (18.4% margin), due to the exceptional rebound in volumes in the quarter and supply conditions not yet impacted by the cost increases.

9M 2021 EBIT was Euro 23.1 million, up 52.5% on Euro 15.1 million in the same period of 2020, after amortisation and depreciation of Euro 18.9 million, up Euro 1.6 million on 2020. The EBIT margin was 8.1% in 9M 2021, compared to 6.7% in 9M 2020. Q3 2021 EBIT was Euro 6.8 million, decreasing from Euro 11.3 million in the same period of the previous year due to the reduced EBITDA and higher amortisation and depreciation which increased to Euro 6.2 million (from Euro 5.9 million).

The 9M 2021 pre-tax profit was Euro 12.0 million (4.2% of sales), reducing 8.8% on Euro 13.2 million for the same period of 2020 (5.8% of sales). This follows the increase in net financial charges, which in the period totalled Euro 11.5 million, including non-recurring charges due to the increase in the value of the SIT Warrants in circulation (Euro 7.6 million), the reversal of the residual amortised cost for Euro 0.4 million and charges for the early settlement of interest rate hedges for Euro 0.6 million, due to the refinancing of the bank debt in August 2021. Net of the stated non-recurring transactions, the adjusted pre-tax profit was Euro 20.6 million (7.2% margin), up 51.4% on the same period of 2020.

The net profit for the period was Euro 9.1 million (3.2% margin), compared to Euro 11.4 million (5.0% margin in 9M 2020, -20.0%).

The net profit adjusted for non-recurring charges was Euro 15.8 million (5.5% margin), compared to Euro 11.8 million (5.2% margin in 9M 2020), with a 33.7% increase.

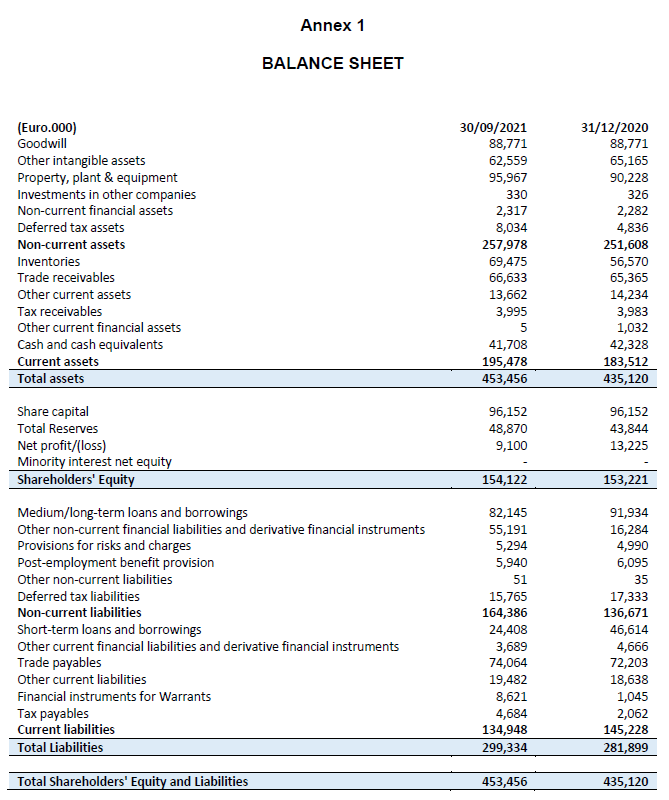

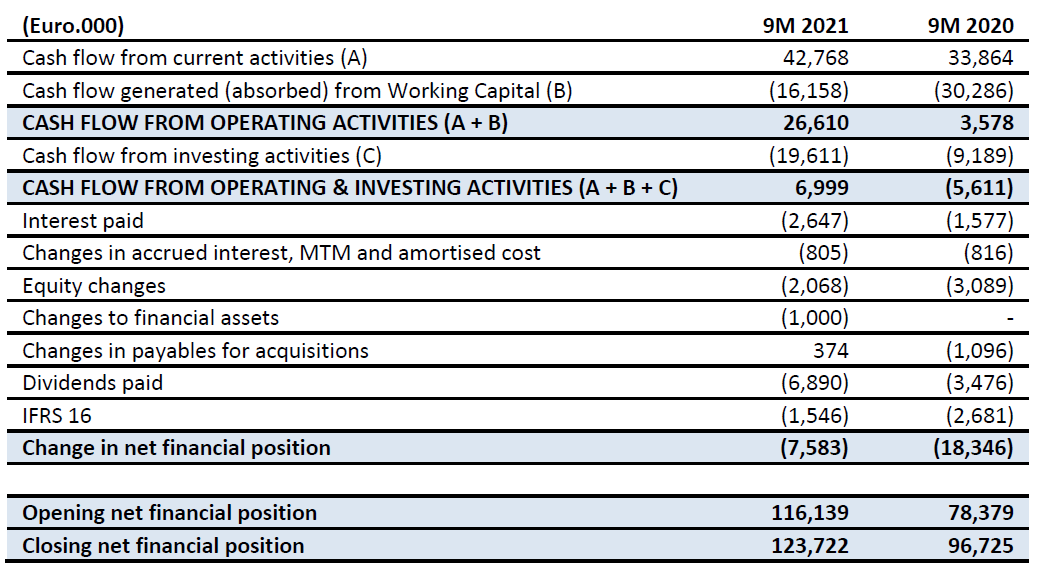

The net financial debt at September 30, 2021 was Euro 123.7 million, compared to Euro 116.1 million at December 31, 2020 and Euro 96.7 million at September 30, 2020, before the acquisition of Janz in December 2020.

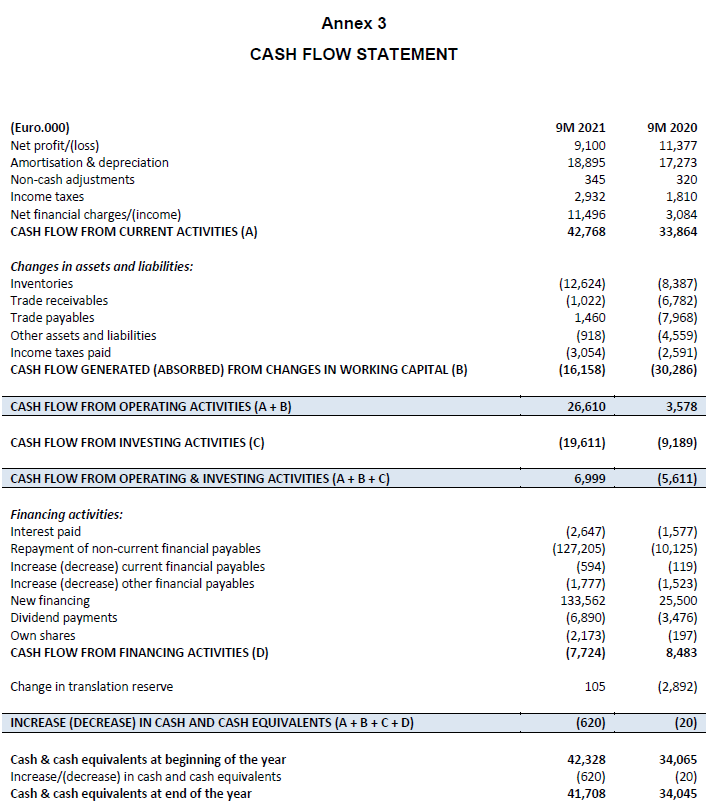

Cash flows in the period were as follows:

Subsequent events and outlook

There were no significant events subsequent to period-end.

Despite continued supply chain uncertainty and component cost volatility, the Company confirms for the 2021 full-year the forecasts published on the approval of the half-year results.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company.

This press release and the results presentation for 9M 2021 are available on the website www.sitcorporate.it in the Investor Relations section.

***