GROWING REVENUES, EBITDA ADJ +79% AND RETURN TO NET PROFIT ADJ.

Highlights

In the first half of 2025 SIT reports:

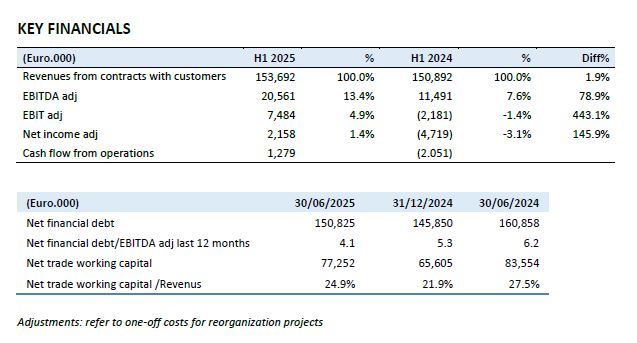

- Consolidated revenues of Euro 153.7 million (+1.9% compared to the same period of 2024);

- Sales of the Heating&Ventilation Division of Euro 106.7 million (+3.1% compared to the first half of 2024);

- Sales of the Metering Division of Euro 43.8 million (-4.3% compared to the same period of 2024)

- EBITDA adj of Euro 20.6 million, 13.4% of revenues, up 78.9% compared to H1 2024;

- Operating result adj of Euro 7.5 million (4.9% of revenues), in improvement compared to the loss of Euro 2.2 million in the same period of 2024;

- Net income adj of Euro 2.2 million vs a loss of Euro 4.7 million in the first half of 2024;

- Operating cash flow for the first half of 2025 positive for Euro 1.3 million after investments of Euro 3.6 million;

- Net financial position of Euro 150.8 million versus Euro 160.9 million as of June 30, 2024.

In the second quarter of 2025 the results are:

- Consolidated revenues of Euro 83.6 million, +2.2% compared to the second quarter of 2024;

- Sales of the Heating & Ventilation Division of Euro 56.5 million, +1.8% compared to the second quarter of 2024;

- Sales of the Metering Division of Euro 25.4 million, substantially in line with the previous year.

***

Padova, 6 August 2025 – The Board of Directors of SIT S.p.A., a company listed on the Euronext Milan segment of the Italian Stock Exchange, at today’s meeting chaired by Federico de’ Stefani, Chairman and Chief Executive Officer of SIT, approved the consolidated results for the first half of 2025.

Federico de’ Stefani, Chairman and Chief Executive Officer of SIT stated:

“The results of the first half of 2025 confirm the effectiveness of the actions put in place to strengthen margins and consolidate our leadership, in a complex context. The increase in adjusted EBITDA and the return to adjusted net profit are tangible signs of our commitment to pursuing sustainable and profitable growth. The Heating & Ventilation Division is the main driver of revenues, with sales recording a strong increase in the Italian and American markets, while in Metering we continue the process of technological innovation and diversification of both product and geography. We look to the second half of the year with confidence, supported by a progressively improving financial position and a renewed operational momentum“.

KEY FINANCIALS

Sales performance

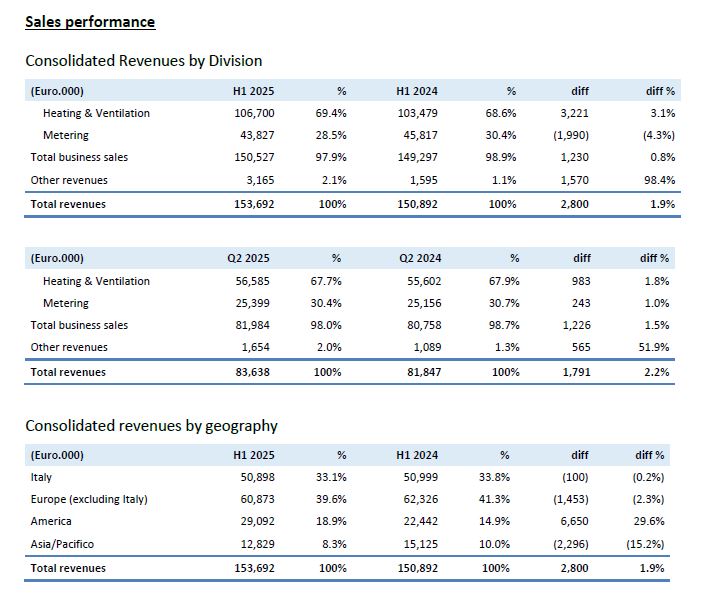

Consolidated Revenues by Division

Consolidated revenues for the first half of 2025 amounted to Euro 153.7 million, an increase of 1.9% compared to the same period of 2024 (Euro 150.9 million). Consolidated revenues for the second quarter of 2025 recorded an increase of 2.2% compared to the same period of 2024.

Sales of the Heating & Ventilation Division in the first half of 2025 amounted to €106.7 million, up -3.1% compared to €103.5 million in the same period of 2024.

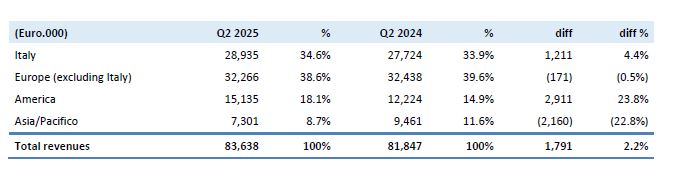

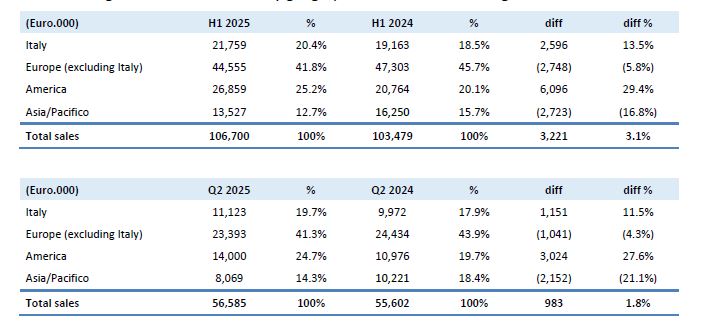

The following table shows the sales by geographical area of the Heating & Ventilation Division:

Geographically, growth in Italy was up 11.5% compared to the same period in 2024, confirming the positive trend recorded in recent quarters, due in particular to ventilation products. On a half-yearly basis, the performance increased by 13.5% to Euro 21.8 million.

As for Europe, excluding Italy, in the second quarter there was a reduction in sales of 4.3% compared to the same period of the previous year. Although overall down, the performance of the quarter is considered positive as the reduction was concentrated in specific areas such as Turkey, which was affected by a negative trend in sales to the local market as well as the reduction of some OEMs operating in Central Heating. Other markets, such as Central Europe, recorded growth of 2.6% in the second quarter, driven by Electronics, while the UK recorded a turnover up 15.3% compared to that recorded in the same quarter of 2024.

America recorded strong growth in the quarter compared to the second quarter of the previous year (+27.6%, +35.1% on a like-for-like exchange rate basis) for both the performance of fireplaces and Central Heating. In the first half of the year, the area grew by 29,4%, 32.9% at constant exchange rates.

The Asia Pacific area recorded a slowdown of 21.1% in the second quarter of 2025 compared to the same period of 2024 due to the performance of China, only partially offset by the good performance of the Australian market.

Sales of the Metering Division amounted to Euro 43.8 million in the first half of 2025, down 4.3% compared to the same period of 2024. In the second quarter, revenues of Euro 25.4 million were recorded, up 1%.

Sales in the Smart Gas Metering segment in the second quarter of 2025 amounted to Euro 17.3 million (-4.7%) compared to Euro 18.1 million in the second quarter of 2024. Half-year sales amounted to Euro 28.6 million (-9.2% compared to the same period of 2024). In the quarter, the Orders/Turnover ratio improved compared to the first quarter and for the second half of the year it is expected to normalize, thanks to the solid order portfolio in place. More than 90% of sales for the period are made in Italy, as foreign turnover forecasts are concentrated in the second half of the year.

Water Metering sales increased compared to the previous year, both in the quarter (Euro 8.1 million, +15.4%) and in the first half (Euro 15.2 million, +6.4%). Sales were made in Spain for 27.1%, in Portugal for 17.7%, in the rest of Europe for 40.5% and in America and Asia for 12.5% and 2.2% respectively.

Economic performance

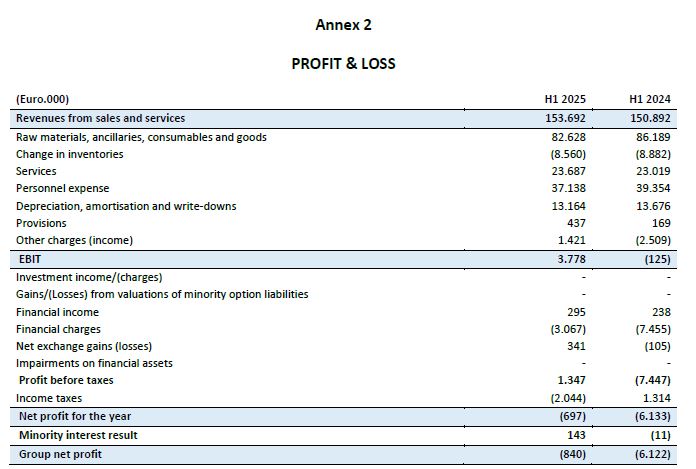

Consolidated revenues for the first half of 2025 amounted to Euro 153.7 million, up 1.9% compared to the same period of 2024 (Euro 150.9 million).

Adjusted EBITDA, amounting to Euro 20.6 million measuring 13.4% of revenues, increased by 78,9% compared to the first half of the previous year (equal to Euro 11.5 million, 7.6% of revenues) and was positively affected by the higher volumes in the Heating&Ventilation division and the consolidation of the efficiency improvements carried out during 2024 and the first half of 2025.

The purchase cost of raw materials and consumables, including changes in inventories, amounted to Euro 74.1 million, with an incidence of 48.2% on revenues, compared to 51.2% recorded in the same period of 2024.

Service costs amounted to Euro 23.7 million compared to Euro 23.0 million in the first half of 2024 (respectively equal to 15.4% and 15.3% of revenues).

Personnel costs reported Euro 37.1 million compared to Euro 39.4 million, meaning 24.2% compared to 26.1% on revenues of the previous year. It should be noted that net of the one-off costs for reorganization operations, personnel costs of H1 2025 amounted to Euro 34.5 million, 22.4% of revenues.

Depreciation, amortization and impairment losses, amounting to Euro 13.2 million, are slightly down compared to the first half of 2024, which had recorded Euro 13.7 million.

The operating result (EBIT) is positive and is equal to Euro 3.8 million, 2.5% of revenues, against a substantial operating breakeven in the first half of 2024 (Euro -0.1 million).

Adjusted operating profit (adjusted EBIT) for the first half of 2025 amounted to Euro 7.5 million, equal to 4.9% of revenues. In the same period of 2024 it was negative for Euro 2.2 million.

Net financial expenses adjusted for the first half of 2025 are Euro 2.8 million, compared to Euro 3.3 million in the same period of 2024. The previous year recorded higher charges of Euro 3.9 million calculated in accordance with IFRS 9 as a result of the agreements signed with the banks.

Income taxes for the period amounted to Euro 2.0 million, mainly representing taxes accrued in foreign subsidiaries and, in line with the policies implemented in the 2024 financial statements, without the allocation of deferred tax assets, implemented in the first half of 2024.

The net result for the period amounted to a loss of Euro 0.7 million compared to a loss of Euro 6.1 million in the same period of the previous year.

The adjusted net result for the first half of the year was a profit of Euro 2.2 million (1.4% of revenues) compared to a loss of Euro 4.7 million (-3.1% of revenues) in the same period of the previous year.

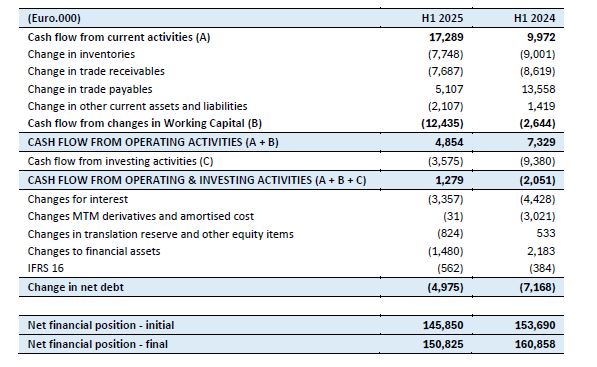

Financial performance

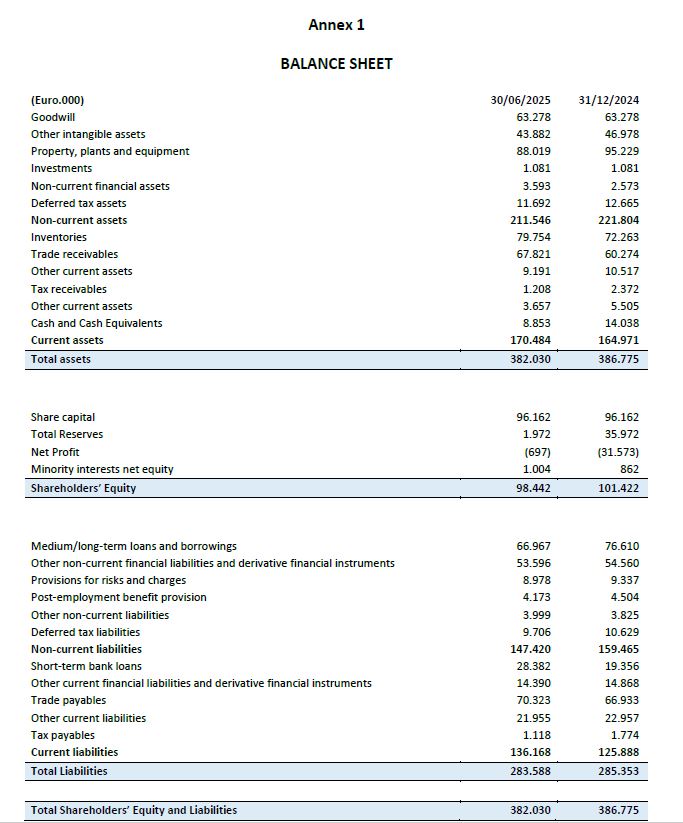

As of June 30, 2025, net financial debt amounted to Euro 150.8 million compared to Euro 160.9 million as of June 30, 2024. The evolution of the net financial position is shown in the following table:

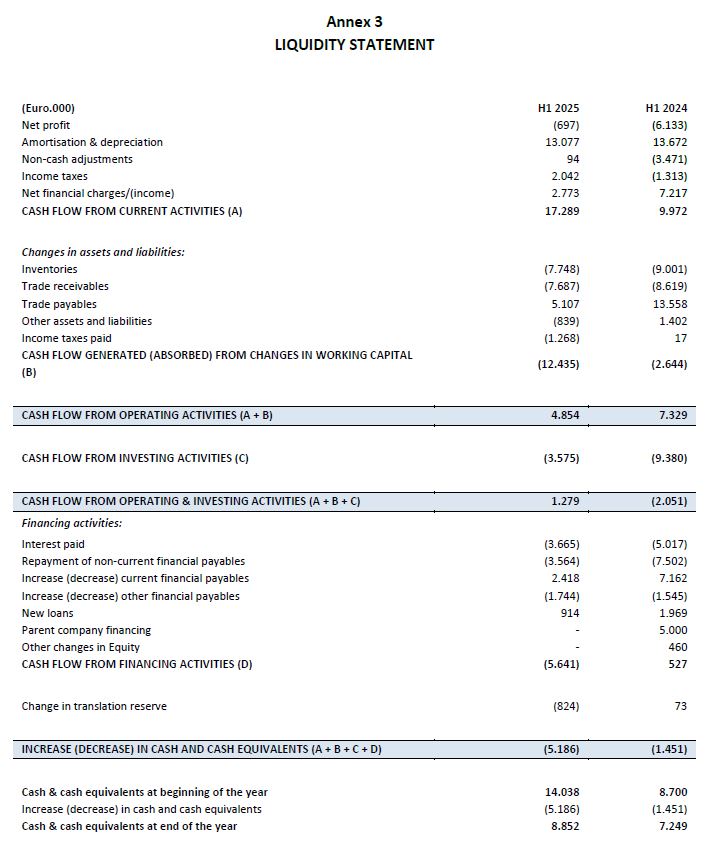

The first half of 2025 shows the generation of cash flows from current operations of Euro 17.3 million, a significant improvement compared to Euro 10.0 million in the same period of 2024.

In the first half of 2025, working capital absorbed Euro 12.4 million compared to Euro 2.6 million in the first half of 2024, a period in which the effects of the destocking were still manifesting.

In the period ended 30 June 2025, the growth dynamics of trade working capital confirm the normal seasonality of the Heating & Ventilation sector in view of the high season, and the significant order book of Smart Gas Metering.

Investment flows amounted to Euro 3.6 million compared to Euro 9.4 million in the first half of 2024.

Cash flows from operations after investments are therefore positive for Euro 1.3 million compared to an absorption of Euro 2.1 million in the first half of the previous year.

Financial flows included interest of Euro 3.4 million in 2025, while in the same period of 2024 a total of Euro 4.4 million was recorded against the cost of bank renegotiation according to IFRS 9.

Net debt therefore increased during the first half of 2025 by Euro 5.0 million, from Euro 145.9 million to Euro 150.8 million.

The net financial debt/adjusted LTM EBITDA indicator continued to improve compared to the first half of the previous year and also compared to the end of 2024, standing at 4.1 times at the end of June 2025, down by more than 30%.

Significant events occurring after the end of the period

No significant events occurred after the end of the half-year.

Outlook

SIT confirms for the 2025 financial year the expected results in the terms already communicated previously.

Therefore, in the second half of the year, an improvement in revenue performance is expected, supported by the normalization of seasonal dynamics in the main business segments.

In particular, the Heating & Ventilation division is expected to return to its usual seasonality profile, reflecting a rebalancing of demand and delivery trends.

In the Metering division, a significant strengthening is expected: Gas Metering should achieve a normalized Orders/Turnover ratio, thanks to a solid order book and business continuity, while Water Metering is expected to grow between 15% and 20% in the second half of the year, in line with the recovery dynamics already observed in previous cycles.

Despite a less favorable revenues and forex mix compared to the first half, adjusted EBITDA is expected to remain solidly positive in double digits, confirming the Group’s ability to generate sustainable profitability.

The net financial position at the end of the year is expected to improve, in line with guidance, at around 140 million euros.

Finally, the recent tariff agreement between the US and the EU, which provides for the introduction of 15% tariffs, is not expected to have a material impact on the Group’s business. It is also confirmed that exports from the production plant in Mexico to the United States are not subject to duties as they are excluded from the scope of the measures, pursuant to the USMCA (formerly NAFTA) treaty.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for the period are available on the website www.sitcorporate.it in the Investor Relations section.

Today at 15:00 CEST, SIT management will hold a conference call to present to the financial community and press the results for the period. You may participate through the following link: https://shorturl.at/69brD

The documentation shall be published in the “Investor Relations” section on the company website (www.sitcorporate.it) before the conference call.

***