Federico de’ Stefani (CEO and Chairman): “Results ahead of expectations. Quality, brand and reputation also in the current market have rewarded SIT’s products.”

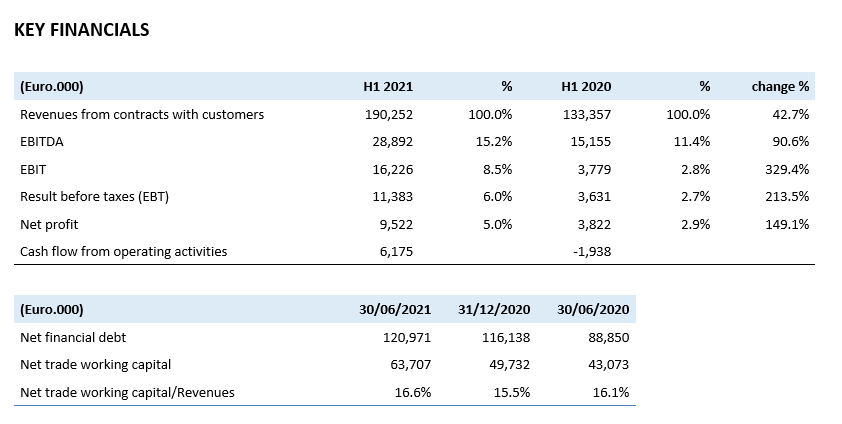

SIT in H1 2021 returned:

- Consolidated revenues of Euro 190.3 million (+42.7% on H1 2020, +34.8% at like-for-like consolidation scope);

- Heating Division sales of Euro 144.7 million (+38.3% on H1 2020);

- Metering Division sales of Euro 43.2 million (+59.0% on H1 2020), including Smart Gas Metering sales of Euro 33.2 million and Water Metering sales of Euro 9.9 million;

- Consolidated EBITDA of Euro 28.9 million (+90.6% on H1 2020);

- The net profit for the period was Euro 9.5 million (5.0% margin), compared to Euro 3.8 million (2.9% margin) in H1 2020.

- Operating cash flow of Euro 6.2 million, after investments of Euro 8.0 million;

- Net financial position at June 30, 2021 of Euro 121.0 million (Euro 116.1 million at end of 2020).

Q2 2021 reports:

- Consolidated revenues of Euro 97.6 million (+62.8% on Q2 2020, +53.6% at like-for-like consolidation scope);

- Metering Division sales of Euro 21.9 million (+103.0% on Q2 2020), including Smart Gas Metering sales of Euro 16.8 million and Water Metering sales of Euro 5.1 million;

- Consolidated EBITDA of Euro 13.8 million (+121.6% on Q2 2020).

Key developments:

- In the first half of the year, the gas boilers market in the main European countries grew 47.6% on H1[1] 2020, +25.2% on the same period of 2019;

- The Heating division reported sales growth in all geographical segments, supported by end-appliance replacement incentives and a gradual post-COVID return to normality in the supply chain;

- Smart Gas Metering sales of Euro 33.2 million (+55.5% on Q2 2020);

- Janz, a company operating in the Water Metering sector, joined the Group on December 31, 2020, and for H1 2021 reported sales growth on the same period of 2020;

- EBITDA in the period of Euro 28.9 million, up 90.6% on the previous year due to the higher volumes, the net effect on prices and the Water Metering division contribution;

- Dividends of Euro 6.9 million paid as per Shareholders’ Meeting motion of April 29, 2021;

- Bond loan of Euro 40 million issued, with 10-year maturity and coupon indexed to ESG parameters.

***

Padua, September 23, 2021

The Board of Directors of SIT S.p.A., listed on the main market of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairman and Chief Executive Officer, approved the consolidated H1 2021 results.

“The approved half-year results reflect the better-than-expected dynamic at the start of the year, particularly for the Heating segment, in which incentives and the close focus on energy efficiency drove demand across all regions. Quality, brand and reputation have rewarded SIT’s products in this expansionary market phase also” stated the Chairman and Chief Executive Officer Federico de’ Stefani. “In line with the integration programmes of JANZ, the newly-acquired Water Metering segment operator – a segment considered strategic for the development of the Group’s metering hub – which strongly supported the Division’s performance in the period, alongside Smart Gas Metering, which we are focused on developing internationally.

[1] Source: EHI – European Heating Industry.

Operating performance

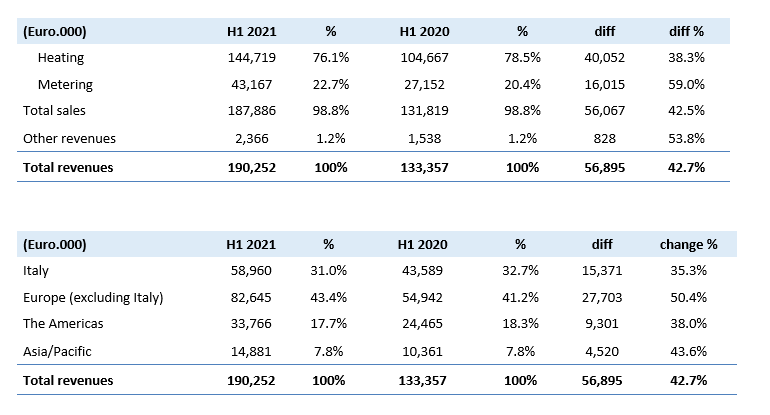

H1 2021 consolidated revenues were Euro 190.3 million, increasing 42.7% on the same period of 2020 (Euro 133.4 million). The 2021 figures include the sales of Janz, the Portuguese Water Metering company acquired at the end of 2020 and reporting sales of Euro 9.9 million for the first half of 2021.

Heating Division sales in the first half of 2021 amounted to Euro 144.7 million, +38.3% compared to Euro 104.7 million in the same period of 2020 (+41.0% at like-for-like exchange rates). In the second quarter, the division’s core sales rose 53.7% to 74.2 million compared with 48.3 million in the same period of 2020, reflecting strong market demand supported by the positive impact of incentives.

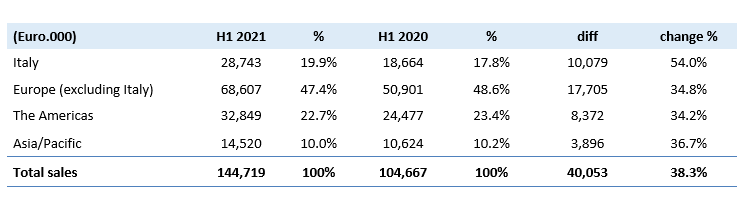

The following table presents Heating Division core sales by region:

Italian sales were up 54% on H1 2020. Recovering Central Heating demand supported this improvement, in addition to incentives; we highlight the increase for fans (+Euro 4.6 million, +76.8%) and flue kits (+Euro 0.7 million, +95%) on markets particularly hit by the 2020 Covid closure.

European sales in H1 2021 rose 34.8% on the previous year to Euro 68.6 million. All regions report improvements on H1 2020; Turkey in particular saw growth of 47.6% (Euro 5.4 million), thanks to recovering Central Heating demand from multinational customers in the country, while the UK – with growth of 55.9% (+Euro 4.4 million) – has rebounded from the particularly poor H1 2020 performance. The central European markets continue to perform well, thanks to the launch of new products.

Sales in the Americas were up 34.2% (+46.3% at like-for-like exchange rates), thanks both to the growth in sales for Storage Water Heating applications (+11.2%) and the good fireplace performance (+65.1%), recovering strongly on the same period of the previous year.

Asia/Pacific sales were up 36.7% to Euro 14.5 million (Euro 10.6 million in H1 2020). China saw growth (6.4% of the division), with a 66.7% recovery on the Covid period and the Central Heating segment performing strongly. Australia also reported an increase of Euro 0.8 million (+28.6%).

The Metering Division reports for H1 2021 sales of Euro 43.2 million (+59.0%), including those of Janz (Water Metering enterprise acquired at the end of December 2020) of Euro 9.9 million in the period. The improvement was 22.3% at like-for-like consolidation scope.

Smart Gas Metering sales for H1 2021 totalled Euro 33.2 million (Euro 27.2 million in the same period of 2020, +22.3%). In the first half of 2021, sales for Residential Meters totalled Euro 30.3 million (91.2% of total sales), while sales for Commercial & Industrial Meters amounted to Euro 2.7 million.

Overseas sales for H1 2021 amount to Euro 1.8 million (5% of the total), compared to Euro 0.6 million n H1 2020 (2% of the total).

Looking to the Water Metering division, this new Group operating segment, following the acquisition of the Portuguese Janz at the end of December 2020, reported H1 2021 sales of Euro 9.9 million. These sales for Euro 5.0 million regarded finished meters and for Euro 4.3 million components.

At consolidated level, purchase costs of raw materials and consumables, including changes in inventories, amounted to Euro 95.9 million (50.4% of revenues, compared to 51.2% in the first half of 2020). H1 service costs total Euro 23.7 million, compared to Euro 17.6 million in the same period of the previous year (respectively 12.4% and 13.2% of revenues). The increase in costs reflect, in addition to the expansion of the Janz scope for Euro 1.7 million, the recovery of production from the general contraction during the H1 2020 lockdown, with an increase in transport costs (+Euro 1.7 million), outsourcing (+Euro 1.5 million) and temporary personnel costs (+Euro 0.9 million).

Personnel expense was Euro 41.0 million, accounting for 21.6% of revenues (23.6% in H1 2020), increasing by Euro 9.5 million. It is recalled that in the first half of 2020, the Group benefitted from grants and supports to address the Covid-19 pandemic during the lockdown, in addition to not allocating the MBO cost. In the first half of 2021, the use of temporary staff increased (+Euro 1.7 million) to deal with the resumption of production activities.

Amortisation, depreciation and write-downs of Euro 12.7 million increased on the previous year (Euro 11.6 million), both due to the increase in new investments in the previous year and the allocation to intangible assets of the higher amount paid for the acquisition of Janz.

Provisions for risks totalled Euro 0.3 million, substantially in line with the previous year. Other charges and income totalled Euro 0.4 million, in line with the first half of the previous year.

EBITDA of Euro 28.9 million was up 90.6% on the same period of the previous year (Euro 15.5 million), benefitting from the Water Metering contribution, in addition to the significant boost to production volumes.

Group EBIT therefore increased from Euro 3.8 million in H1 2020 to Euro 16.2 million in H1 2021, with the margin increasing from 2.8% to 8.5%.

Financial charges in H1 2021 totalled Euro 5.0 million, increasing Euro 3.2 million on the same period of 2020. This increase is due to non-recurring items concerning the change in the fair market value of the SIT Warrants and the value of hedges settled on the early repayment of the bank loan in August.

Adjusted net financial charges, net of the above-stated non-recurring components H1 2021 totalled Euro 2.1 million, compared to Euro 1.7 million in the same period of the previous year.

Income taxes in the period totalled Euro 1.9 million, net of non-recurring income of Euro 1.7 million regarding the agreement with the Tax Agency on the calculation of the economic benefits from intangible assets (”Patent Box” optional system).

The net profit for the period was Euro 9.5 million (5.0% margin), compared to Euro 3.8 million (2.9%) in the same period of 2020.

The adjusted net profit, net of the above-stated non-recurring effects, was Euro 10.5 million (5.5% margin), compared to Euro 3.6 million (2.7%) in the same period of 2020.

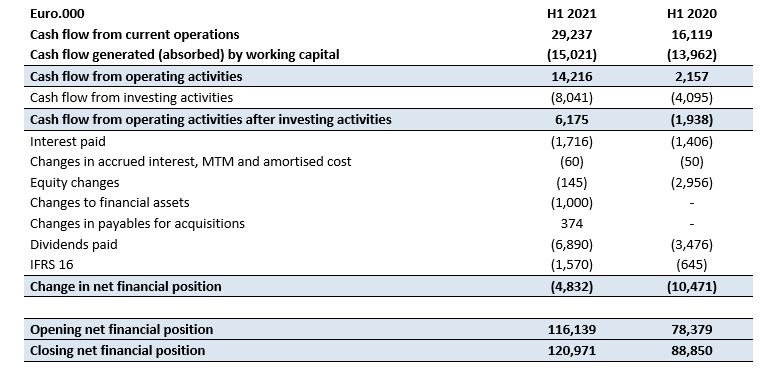

Cash Flow performance

The net financial debt at June 30, 2021 was Euro 121.0 million, compared to Euro 88.9 million at June 30, 2020, increasing Euro 32.1 million, including the effects from the acquisition of Janz, the Portuguese Water Metering enterprise acquired in December 2020.

The movements in the net financial position are reported below:

Operating cash flows in the first half of 2021 totalled Euro 29.2 million, compared to Euro 16.1 million in the first half of 2020, due to the improved EBITDA on the comparable period.

Cash flows absorbed by working capital movements in the first half of 2021 totalled Euro 15.0 million, of which approx. Euro 13.8 million due to commercial working capital. Inventory increased Euro 10.7 million, in line with the Heating business seasonality ahead of the high season. For trade receivables and payables, respectively an absorption of capital of Euro 7.9 million and a release of Euro 4.8 million was reported, in line with the increased business volumes in the period.

Ordinary cash investments in H1 2021 totalled Euro 8.0 million, compared to Euro 4.1 million in the same period of 2020, with the latter impacted by COVID related delays.

Operating cash flows after investments therefore generated Euro 6.2 million, compared to an absorption of Euro 1.9 million in H1 2020.

Financing activity cash flows in the period included interest of Euro 1.8 million and dividends of Euro 6.9 million; the IFRS 16 impact was Euro 1.6 million.

The net financial position at June 30, 2021 was Euro 121 million, increasing Euro 4.8 million on December 31, 2020 (Euro 116.1 million).

Subsequent events to the end of the period

Fully supporting our Sustainability approach, SIT in July adopted a Governance system focused on outlining the Group’s ESG strategy and trajectory in order to achieve “sustainable success” – according to the Corporate Governance Code for companies listed on the Mercato Telematico Azionario (“MTA”) (Italian Stock Exchange).

The Board of Directors of SIT S.p.A. therefore on July 26 appointed the Director Chiara de Stefani as Corporate Sustainability Director, granting her the powers necessary to co-ordinate the Group Sustainability Plan, the associated improvement policies and objectives and to facilitate stakeholder engagement and communication.

On August 6, 2021, SIT agreed with a bank syndicate a Euro 90 million 5-year amortising loan to refinance the bank debt and meet ordinary Group financial needs. The loan’s unguaranteed interest rate is indexed to a sustainability rating (“ESG”) issued by the international EcoVadis agency.

On August 31, 2021, the subsidiary SIT Manufacturing N.A.S.A. de C.V., headquartered in Mexico, completed the transaction agreed in July with the US company Emerson Electric Co. for the acquisition of the electronic valves for gas storage water heaters product line (NGA product line), a very significant market segment in the United States (approx. 73% of the market in 2020) and forecast to grow over the coming years. The acquisition allows the expansion of the current product portfolio in the market of components for storage water heaters in which SIT is already present with the mechanical valve. The transaction therefore strengthens SIT’s competitive positioning and market share.

Outlook

The Group forecasts H2 2021 consolidated sales substantially in line with H1 and the return of YoY growth of between 15 and 20%.

Sales at the two divisions are expected to develop in line with the consolidated annual growth forecasts.

The Heating Division again in the second half of the year forecasts sales growth supported by sector incentives, while the Metering Division shall benefit from the Water Metering contribution, with annual sales expected in line with that announced on acquisition.

Current Smart Gas Metering forecasts are for overseas sales to account for between 5 and 10% of the division’s total.

Consolidated EBITDA is expected to increase in the year, with a margin substantially in line with the previous year forecast, taking into consideration the impact in H2 of the increase in raw materials and the annual effect of development and overhead costs to support growth.

The Group net financial position is expected to significantly improve on June 30, 2021, considering the impact of the NGA acquisition in Mexico, the investments in the start up of the plant in Tunisia and the advancement of the construction of the new R&D laboratories.

The assumptions used in the estimates consider a general economy not affected by unforeseeable events. Should the economic landscape however change significantly, the actual results may differ from the forecasts.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company.