SIT reports for 9M 2022:

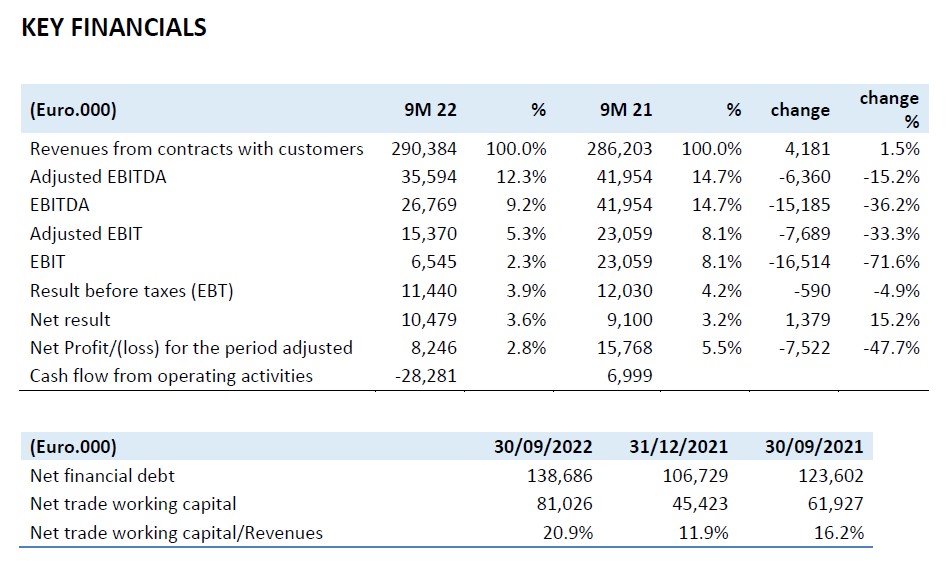

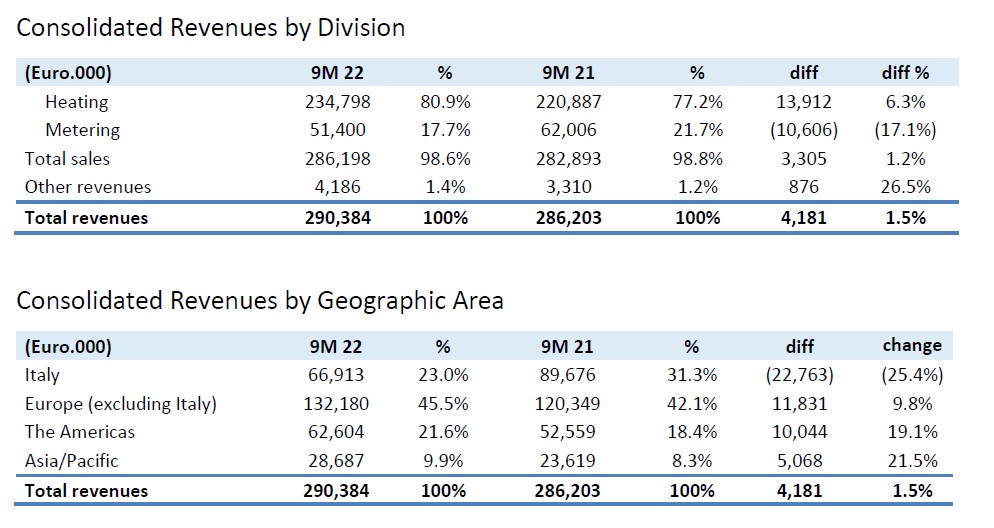

- Consolidated revenues of Euro 290.4 million (+1.5% on 9M 2021);

- Heating Division sales of Euro 234.8 million (+6.3% on 9M 2021);

- Metering Division sales of Euro 51.4 million (-17.1% on 9M 2021);

- Consolidated Net Profit of Euro 10.5 million (+15.2% on 9M 2021);

- Net financial position at September 30, 2022 of Euro 138.7 million (Euro 123.6 million at September 30, 2021).

Q3 2022 reports:

- Consolidated revenues of Euro 95.7 million (in line with Q3 2021);

- Heating Division sales of Euro 77.0 million (+1.0% on Q3 2021);

- Metering Division sales of Euro 17.3 million (-8.4% on Q3 2021);

***

Padua, November 3, 2022

The Board of Directors of SIT S.p.A., listed on the Euronext Milan segment of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairman and Chief Executive Officer, approved the consolidated 9M 2022 results.

“The nine month figures reflect the slowdown on our markets across a large part of Europe” stated Federico de’ Stefani, Chairman and CEO of SIT, who continues “We – the market leaders – have certainly suffered while demand volatility has lowered our expected results. In preparation of the winter season, we have implemented a procurement policy that allows us to respond quickly to increasingly unstable demand, while guaranteeing service to our customers. We continue to be focused on offering innovative, efficient, safe and high quality solutions.

We expect that inflation in 2023 may have a significant impact on both our costs and revenues. We have seen exciting developments in the water metering sector and generally expect to participate in new major tenders on both the domestic and international markets. We also expect next year to benefit from the broader product portfolio brought on stream through R&D and consequently greater market share”.

Operating performance

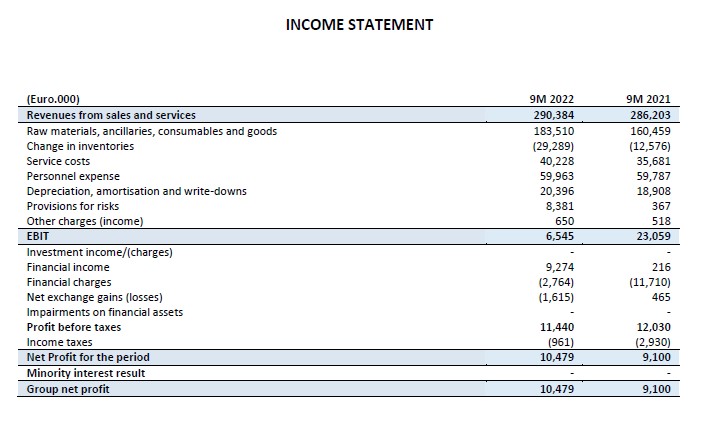

9M 2022 consolidated revenues were Euro 290.4 million, increasing 1.5% on the same period of 2021 (Euro 286.2 million).

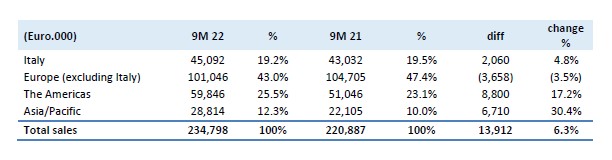

Heating Division sales for first nine months of 2022 amounted to Euro 234.8 million, +6.3% on Euro 220.9 million in the same period of 2021 (+2.9% at like-for-like exchange rates). In the third quarter of 2022, core division sales totalled Euro 77.0 million, up 1% on Q3 2021.

The following table presents Heating Division core sales by region according to management criteria:

Sales in Italy rose 4.8% on 9M 2021, thanks to strong demand in the Catering sector (Euro 1.7 million, +57.6%) and for Direct Heating, which rose Euro 0.7 million (+12.1%), on the basis of pellet stoves and space heaters. Central Heating reported a contraction of Euro 1.2 million (-4.4%), mainly due to flue systems.

Sales in Europe (excluding Italy) in the first nine months of 2022 decreased Euro 3.7 million (-3.5%) on the same period of the previous year. Turkey, the top shipping market with 10.7% of division sales, contracted 5.5% on 2021 and particularly the Central Heating segment due to the effect of OEM demand influenced by the market, while the UK, 6.0% of division sales, saw a 14.3% decrease for Central Heating – Flues and Mechanical controls – improving on the previous quarter due to the normalisation of the supply chain. Central Europe remains strong, thanks to the introduction of new products, up 12.8% on Q1 2021 (Euro 4.7 million).

Sales in the Americas rose 17.2% (+5.2% at like-for-like exchange rates), thanks to fireplaces growth of Euro 6.1 million (+22.5%). Storage Water Heating applications in 9M 2022 decreased 6.5% (Euro 1.0 million). Central Heating applications grew Euro 4.2 million (+56.5%), particularly in electronics.

Asia/Pacific sales were up 30.4% to Euro 28.8 million (Euro 22.1 million in 9M 2021). Growth was reported in China (7.4% of the division), up 22.9%, with a Euro 3.2 million improvement in the retail market of the Central Heating segment and in Australia with an increase of Euro 1.2 million (+22.2%).

Among the main product families, Mechanical controls sales were up (+32.9%, Euro 13.1 million), as were Fans (+7.2%, Euro 2.0 million). Supply chain operating conditions improved for these categories; at the application segment level, Central Heating accounted for 58.8% of division sales, increasing 4.3%, while Direct Heating (20.1% of the division sales) rose 11.5% due to the strong fireplaces market in the USA and for applications sold in Italy.

Metering Division sales were Euro 51.4 million (Euro 62.0 million, reducing 17.1% on the same period of the previous year).

In 9M 2022, Smart Gas Metering sector sales totalled Euro 33.0 million, reducing 29.3% on 9M 2021. Sales in Italy accounted for 92.3% of the total, while overseas sales accounted for 7.7% (from Greece, Central Europe, the UK and India).

Water Metering sales totalled Euro 18.4 million, up 20.3% on 9M 2021. Portugal accounts for 23.6% of sales, Spain for 30.3%, the rest of Europe for 33.3% and America and Asia respectively for 6.7% and 6.1%.

In the third quarter of 2022 we have accrued Euro 8.8 million as a best estimate for settlement costs (including legal expenses) with a customer regarding a dispute concerning a supply.

Consolidated 9M 2022 Adjusted EBITDA was Euro 35.6 million (12.3% revenue margin), decreasing 15.2% on Euro 42.0 million (14.7% margin) in the first nine months of 2021.

The impact of volumes is negative for Euro 7.8 million, while the net contribution of prices is positive for Euro 4.5 million, as the increased cost of components and raw materials in the period, and partly those of processing costs, was transferred to the market. Operating costs increased Euro 6.0 million, particularly due to the impact of logistics and transport costs (increasing by approx. Euro 3.5 million) and increased R&D and production costs. EBITDA benefitted from exchange gains of Euro 2.7 million.

EBIT in 9M 2022 totalled Euro 6.5 million (2.3% margin), after amortisation, depreciation and write-downs of Euro 20.4 million, with Adjusted EBIT of Euro 15.4 million (5.3% margin). EBIT in 9M 2021 was Euro 23.1 million (8.1% margin).

Net financial income of Euro 6.5 million was reported in 9M 2022, due to the positive effect from the change in the fair value of the SIT warrants, settled in Q3, with a positive impact of Euro 8.7 million. Adjusted net financial charges totalled Euro 2.2 million (0.8% of revenues), reducing on the same period of the previous year (Euro 2.9 million, 1.0% of revenues).

Pre-tax profit was Euro 11.4 million (3.9% revenue margin), compared to Euro 12.0 million (4.2% margin) in the same period of 2021.

The net profit for the period was Euro 10.5 million (3.6% margin), compared to Euro 9.1 million in 9M 2021, which included the positive impact of the extraordinary tax income of Euro 1.8 million relating to the Patent Box.

Net of non-recurring charges and income, the adjusted net profit in 9M 2022 was Euro 8.2 million, compared to Euro 15.8 million in the same period of the previous year (2.8% and 5.5% of revenues respectively).

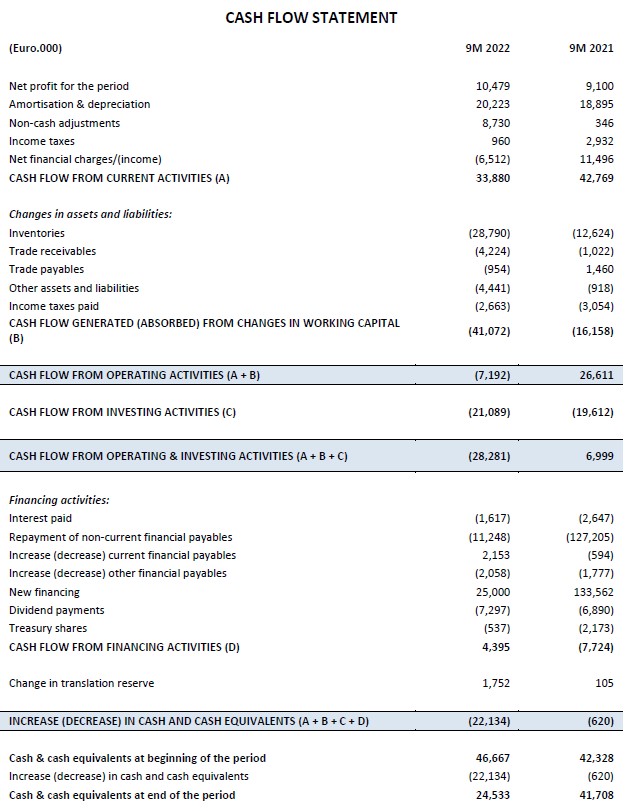

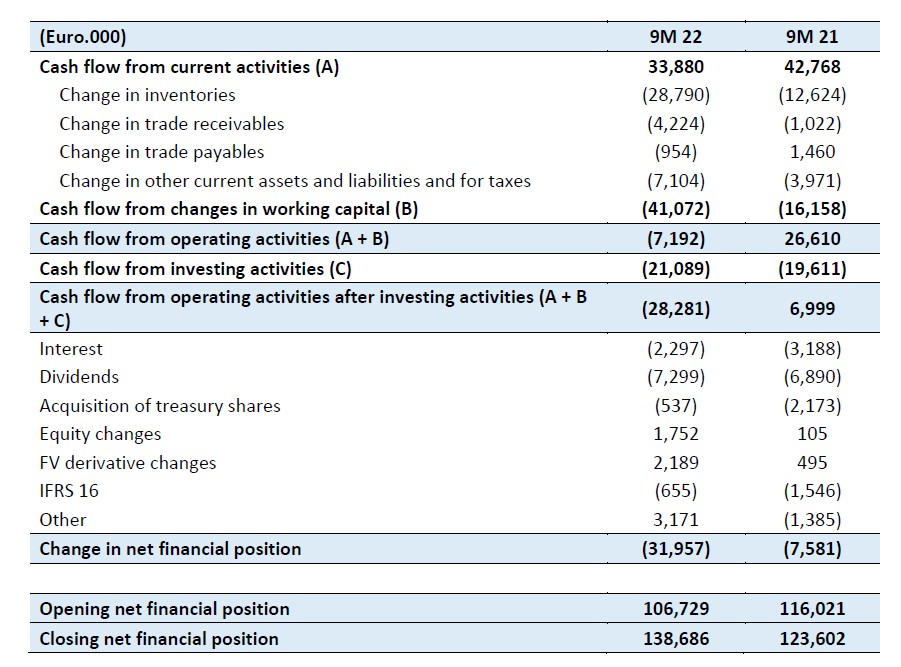

Cash Flow performance

The net financial debt at September 30, 2022 was Euro 138.7 million, compared to Euro 123.6 million at September 30, 2021.

The movements in the net financial position are reported below:

Cash flows from operating activities of Euro 33.9 million were generated in the first nine months of the year, with an absorption as a result of the increase in working capital of Euro 41.1 million, of which Euro 28.8 million due to increased inventories on the basis of the electronic component procurement policy to offset the impact of shortages and guarantee service to customers.

Investing activities absorbed cash of Euro 21.1 million, compared to Euro 19.6 million in the same period of the previous year.

Cash flows from operating activities after investments of Euro 28.3 million were therefore absorbed in the period, compared to a generation of Euro 7.0 million in 9M 2021.

Financing activity cash flows in the period included interest of Euro 2.3 million and dividends of Euro 7.3 million, in addition to the purchase of treasury shares for Euro 0.5 million; the IFRS 16 impact was Euro 0.7 million, while the fair value of hedging derivatives improved Euro 2.2 million.

The net financial position at September 30, 2022 was Euro 138.7 million, increasing Euro 32.0 million on December 31, 2021 (Euro 106.7 million).

Subsequent events to the end of the period

There were no significant events subsequent to the end of third quarter.

Outlook

The performance in the third quarter confirmed the considerable market volatility, with a slowdown on the sales market, particularly in Europe. The backlog remains at high levels, but given the uncertainty, customers may delay orders and shipments planned for FY2022.

Therefore, forecast consolidated revenues for the present year may be at last year’s levels, with an expected margin of slightly under 12% (Adjusted EBITDA).

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for the period are available on the website www.sitcorporate.it in the Investor Relations section and will be presented to the market today at 3PM (CET). You can participate by clicking the following link: meet.google.com/obd-rngn-ncz

***

Annex 1

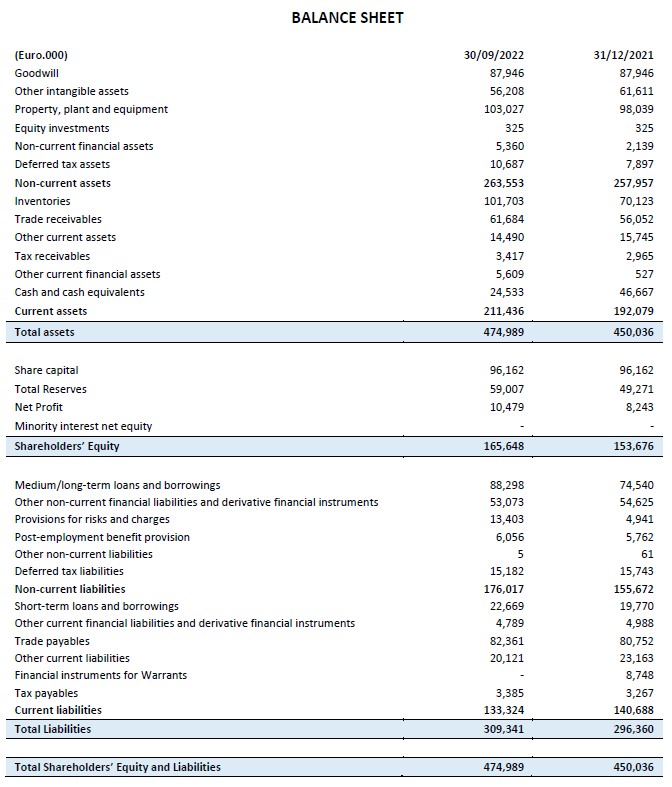

Annex 2

Annex 3