SIT reports Q1 2020 revenues of Euro 73.4 million.

Net profit of Euro 4.2 million.

Adaptability, strong customer relationships and remote working: despite the global pandemic,

the company has responded well.

SIT for Q1 2020 reports:

• Consolidated revenues of Euro 73.4 million (-8.9% on Q1 2019);

• Heating Division sales of Euro 56.4 million (-9.2% on Q1 2019);

• Smart Gas Metering Division sales of Euro 16.4 million (-7.3% on Q1 2019);

• Consolidated EBITDA of Euro 8.9 million (-28.6% on Q1 2019);

• Consolidated net profit of Euro 4.2 million (5.7% margin);

• Net financial position at March 31, 2020 of Euro 101.6 million (Euro 91.6 million in Q1 2019), in view of strong support to strategic suppliers to the Italian and overseas production chain.

Main period developments:

• Boilers market in the main European countries drops 4.2% on Q1 2019 (Source: EHI – European Heating Industry.);

• During the lockdown, SIT ensured operating continuity and maintained solid relations with customers;

• The Heating division reported growth in Central Europe, thanks to the introduction of SIT components to new products by customers and end market growth;

• The Smart Gas Metering division decline was due to suspension of residential installation activities at the beginning of the lockdown;

• SIT can rely on, for the coming quarters, the additional liquidity guaranteed by the bank system;

• Board of Directors approves launch of treasury share buy-back programme.

***

Padua, May 13 2020 –

The Board of Directors of SIT S.p.A., listed on the main market of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairman and Chief Executive Officer, approved the consolidated Q1 2020 results.

“Despite the visible impact of the Covid-19 emergency on the Q1 results, SIT maintained operations and further consolidated customer relations” stated Federico de’ Stefani. “The company’s quick reactivity, the availability of employees and the adaption to the global pandemic scenario are not taken for granted. We are very satisfied of how we reacted to this period of major uncertainty, quickly adopting new conduct without any fear of change. Remote working, thanks to a pilot project launched in 2019, has worked very well and we shall continue to adopt it for all roles for which it is possible and for the required timeframe. Although we expect the economic crisis to deepen, the duration of which we cannot predict, we expect that our products will remain of key importance to households across the world. Our houses have now become also our offices, our gyms, our favourite restaurants; the uncertainty regarding the development of the pandemic has led households to increasingly use energy control systems in their homes. I hope that, in this sense, government measures such as the building superbonus proposal can be a real help towards solutions to improve energy efficiency, helping our economy to start again from a key sector such as that in which we operate”.

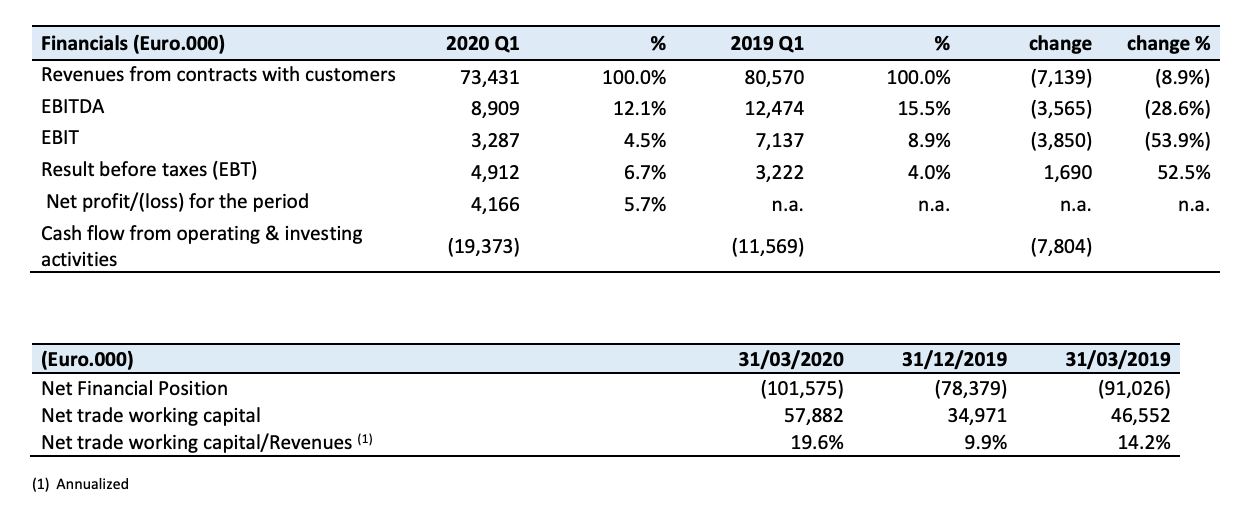

KEY FINANCIALS

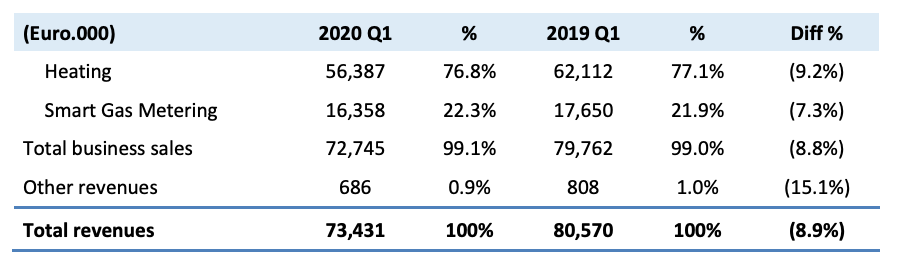

Q1 2020 consolidated revenues were Euro 73.4 million, decreasing 8.9% on Q1 2019 (Euro 80.6 million)

Heating Division sales amounted to Euro 56.4 million, compared to Euro 62.1 million (-9.2% compared to Q1 2019).

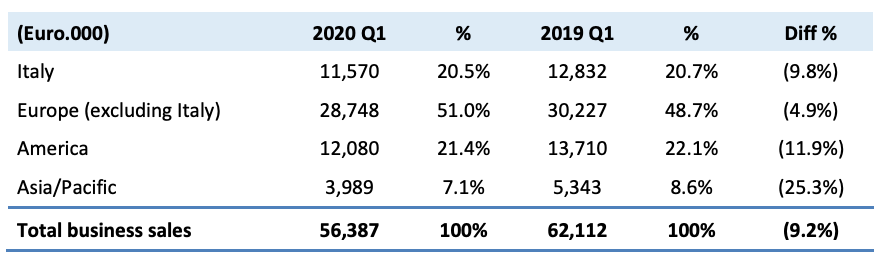

The geographic distribution of Heating Division sales was as follows:

The 9.8% decline on the Italian market reflects a number of weeks of lockdown at major customers due to Covid-19. The condensation boiler end market in Italy in Q1 2020 contracted 11.5% over the same period of the previous year (source: EHI – European Heating Industry).

In Europe, SIT reported a contraction of approx. 4.9% (Euro 1.5 million), almost entirely regarding the English market – down 10.8% on the same period of the previous year.

Also in Europe, sales in Turkey (10.6% of division sales) remained unchanged on Q1 2019. Other central European markets saw growth following the introduction of new product platforms by customers and end market growth.

On the American market, SIT declined 11.9% (14.5% at like-for-like exchange rates), reflecting the mild weather conditions in Q1 2020, in addition to the timing of deliveries to some major customers.

Asia Pacific (Euro -1.4 million, -25.3%) was impacted by the Covid-19 blockage of the Chinese market (3.9% of division sales), down 19.0% (Euro -0.5 million), while decreasing also on the middle eastern markets (Euro -0.9 million).

Smart Gas Metering Division sales were Euro 16.4 million (Euro 17.7 million, -7.3% on the same period of the previous year). The performance is particularly due to the residential segment (-7.4%), following delays from the suspension of installation activities as a result of Covid-19. The backlog at March 31, 2020 was Euro 43.5 million, while awaiting the results of additional tenders.

Q1 2020 EBITDA was Euro 8.9 million, compared to Euro 12.5 million in the previous year (respectively a 12.1% and 15.5% margin). The performance was significantly impacted by reduced volumes (approx. Euro 4.6 million), in part offset by operating and procurement efficiencies. The

currency effect had a positive impact of Euro 0.3 million.

Q1 2020 EBIT was Euro 3.3 million, compared to Euro 7.1 million in Q1 2019 (respectively 4.5% and 8.9% margin).

The profit before taxes of Euro 4.9 million (6.7% of sales) was impacted by positive currency differences of Euro 2.2 million, in addition to net financial charges of Euro 0.6 million.

The period net profit was Euro 4.2 million (5.7% margin).

Operating cash flows absorbed Euro 19.4 million after net period investments of Euro 0.6 million.

The movement reflects the seasonal trend in net working capital, ensuring timely payments to suppliers, as well as the choice not to resort to factoring. Despite the uncertain economic situation, at March 31, 2020 no significant or abnormal overdue positions are reported.

The Net debt amounted to Euro 101.6 million at March 31, 2020, compared to Euro 78.4 million at December 31, 2019 and Euro 91.0 million at March 31, 2019.

Significant subsequent events and outlook

Following the issue of Presidential Decree of April 10, 2020, SIT made a request to the competent prefectures for the continuation of production and logistics activities at the Italian plants. Therefore, from April 14, 2020, production resumed, in compliance with the applicable safety and health and hygiene regulations. Operations were further normalised from May 4, 2020, coinciding with the start of Phase 2.

In the first quarter, SIT’s overseas facilities – except for China – were not significantly impacted by the obligatory closures required by the respective Governments.

SIT is continuing to adopt remote working for all functions for which it is applicable.

With regard to Sales orders, a number of updates and the identification of possible future scenarios with the main customers are in progress. In this uncertain environment, SIT can rely on the additional liquidity agreed with the banking system to manage any temporary needs which may arise.

Share buy-back programme

In execution of the authorisation granted by the Shareholders’ Meeting of May 6, 2020, the Board of Directors of SIT today approved the launch of a share buy-back programme, the duration, value and maximum quantity of which were established by the authorisation of the Shareholders’ Meeting of May 6, 2020. Within the scope of the purposes authorised by the Shareholders’ Meeting of May 6, 2020, the Board of Directors approved implementation of the programme for the purchase and disposal of treasury shares for the following purposes:

– fulfil the obligations arising from share option programmes or other allocations of shares to employees (including any classes which, in accordance with the applicable legislation, are treated as such), or to members of the administrative or control bodies of the issuer or of an associated company that the Company wishes to incentivize and retain;

– carry out sales, exchanges, conferments or other utilisations of treasury shares for the acquisition of investments and/or buildings and/or the conclusion of contracts (also commercial) with strategic partners and/or for the completion of industrial projects or extraordinary financial operations, which are considered necessary within the Company or Group expansion plans; and

-support the liquidity of the share, ensuring fluid trading and preventing price movements not in line with the market.

The purchases will be carried out, also through subsidiaries, in accordance with Article 132 of Legislative Decree 58/98 (CFA), Article 144-bis of the Issuers’ Regulations and all applicable regulations, in addition to Consob permitted practices.

The maximum number of treasury shares that may be purchased may not exceed 10% of the Company’s pro tempore share capital (also taking into account the treasury shares held by the Company and its subsidiaries).

The maximum number of treasury shares that may be purchased daily may not exceed 25% of the average daily number of shares traded on the market during the previous 20 days, in accordance with the applicable regulations.

With reference to the minimum and maximum price, no purchases of ordinary treasury shares may be made at a unit purchase price (i) at least 20% lower than the reference price that the share records in the session of the day prior to each individual purchase transaction and (ii) higher than the highest price between the price of the last independent transaction and the price of the highest current independent purchase offer on the same market, in accordance with the provisions of Article 3 of EUvDelegated Regulation No. 2016/1052, it being understood that, in relation to disposals, this price limit may be waived in the case of exchanges or sales of treasury shares as part of the execution of industrial and/or commercial projects and/or in any case of interest to the Company, and in the case of sales of shares in execution of incentive plans.

The authorization granted by the aforementioned shareholders’ motion will be effective for a period of 18 months from the date of the motion, i.e. until November 6, 2021.

Self-assessment of the Board of Statutory Auditors

In accordance with the conduct rules for Boards of Statutory Auditors of listed companies, the Boards of Statutory Auditors of SIT has carried out the self-assessment and has submitted the selfassessment report to the Board. The Board of Directors of the company examined the selfassessment report and acknowledged the self-assessment of the Board of Statutory Auditors as outlined in the report.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release fairly represent the accounts and the books of the Company.

This press release and the results presentation for Q1 2020 are available on the website www.sitgroup.it in the Investor Relations section.

***

The SIT Group, through its two divisions Heating and Smart Gas Metering, creates intelligent solutions that manage climate control and measure consumption for a more sustainable world. A marketleading multinational company, listed on the MTA segment of Borsa Italiana, SIT aims to be the number one sustainable partner for control solutions for its customers, focusing on experimentation and the use of alternative gases with low environmental profiles. The Group comprises production companies located in Italy, Mexico, the Netherlands, Romania and China, in addition to a commercial and distribution structure covering all global markets.

Investor Relations

Paul Fogolin

E. paul.fogolin@sitgroup.it

T. +39 049 829 3111

Mara Di Giorgio

E. mara@twin.services

M +39 335 7737417

Ufficio Stampa SIT Spa

Chiara Bortolato

E. chiara@twin.services

M. +39 347 853 3894